177

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

22. SHARE-BASED PAYMENT PLAN

At December 31, 2015, as described below, the Group has one valid share option plans which it has granted to certain

employees. It was approved in 2011.

The approved plan that remain in effect have a three-year accrual period and the given strike price, and, if applicable, is

exercised, where applicable, through the delivery of the shares.

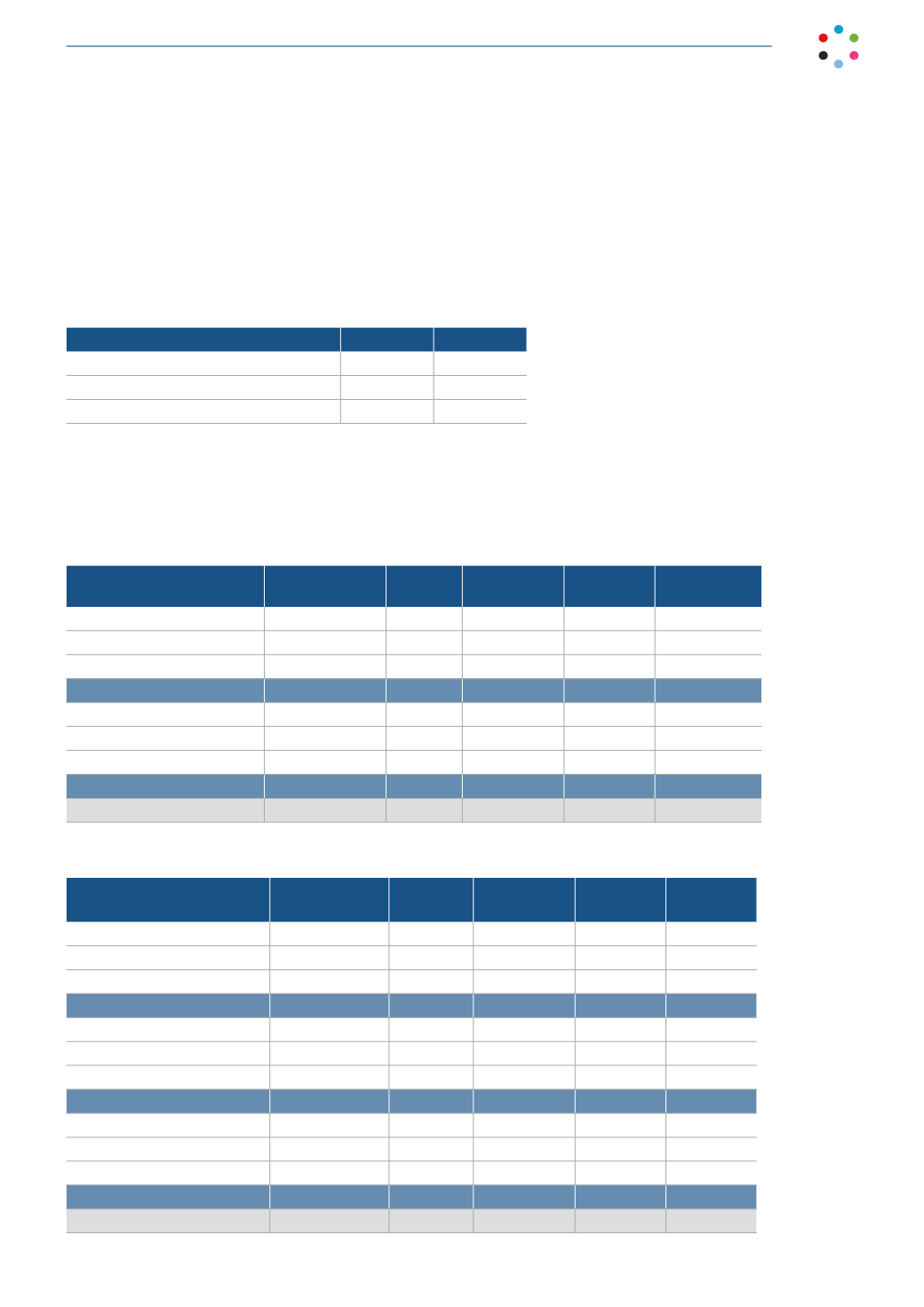

The most relevant assumptions used in the measurement are as follows:

2010 Plan 2011 Plan

Strike

7.00

5.83

Yield on the share (dividend yield)

5.5%

5.5%

Volatility

50%

37%

There were no new share option plans in 2015 and 2014, and therefore, during 2015 and 2014, no amounts were

charged on the income statement related to these plans (Note 24.2).

The beneficiaries of these plans are directors and executive directors of Group companies.

These share-based payment schemes in 2015 are shown in the following table:

Number of

options

Strike

price

Assignment

date

From

To

Options granted

1,297,650

7.00

2010 07/28/2013 07/27/2015

Options canceled

(93,000)

7.00

2010

Options exercised

(1,204,650)

7.00

2010

2010 Plan

-

Options granted

673,225

5.83

2011 07/27/2014 07/26/2016

Options canceled

(57,000)

5.83

2011

Options exercised

(328,275)

2011 Plan

287,950

Total outstanding plans

287,950

These share-based payment schemes in 2014 are shown in the following table:

Number of

options

Strike

price

Assignment

date

From

To

Options granted

319,163

5.21

2009 07/29/2012 07/28/2014

Options canceled

(9,000)

5.21

2009

Options exercised

(310,163)

5.21

2009

2009 Plan

-

Options granted

1,297,650

7.00

2010 07/28/2013 07/27/2015

Options canceled

(93,000)

7.00

2010

Options exercised

(646,150)

7.00

2010

2010 Plan

558,500

Options granted

673,225

5.83

2011 07/27/2014 07/26/2016

Options canceled

(57,000)

5.83

2011

Options exercised

(171,775)

2011 Plan

444,450

Total outstanding plans

1,002,950

The Group has treasury shares to comply with these commitments.