183

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

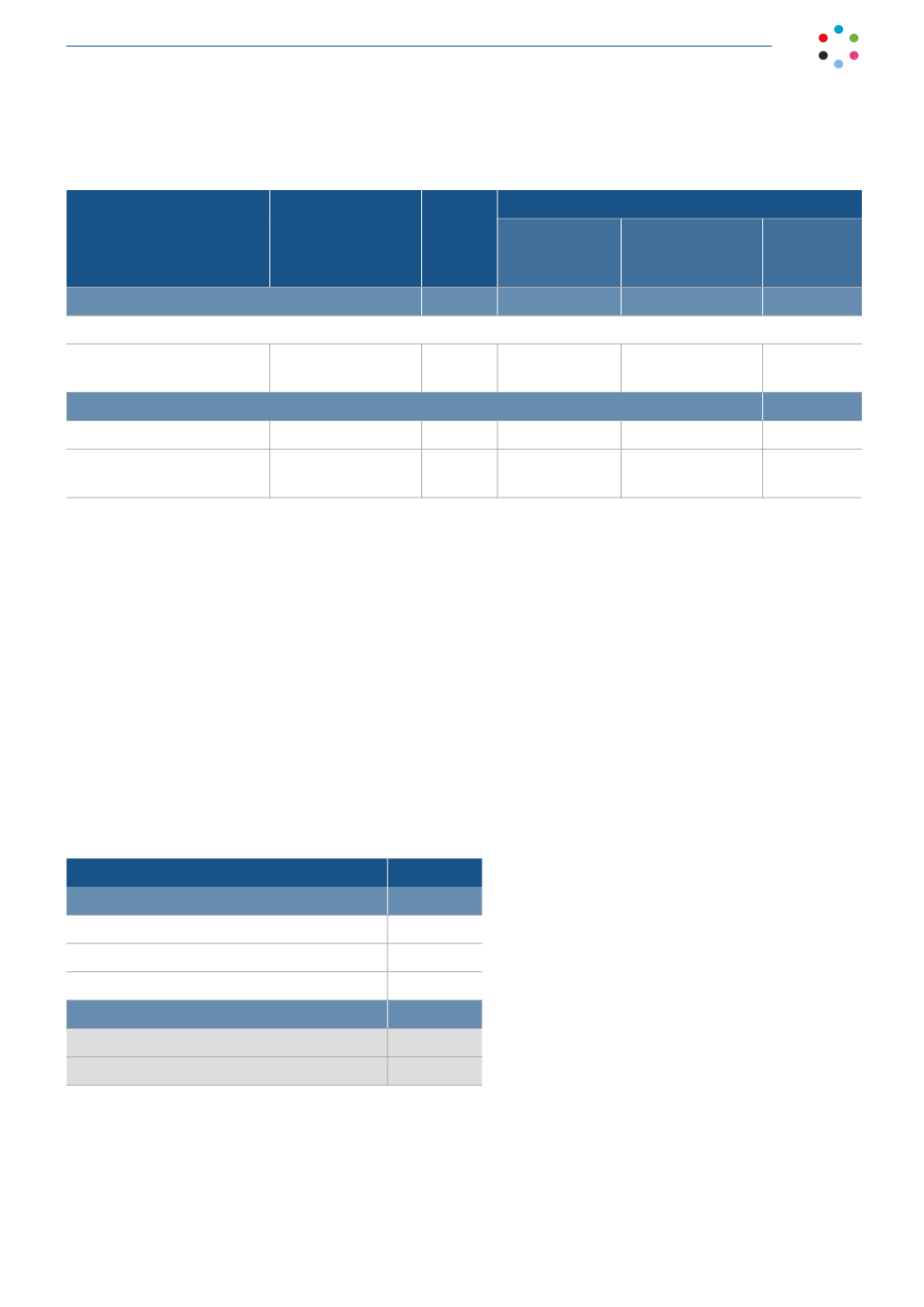

Breakdown of the fair value of the Group’s assets in 2014:

Thousands of euros

Measurement date

Total

Fair value measurement used

Listed value on

active markets

(Level 1)

Measurement date

Total

Assets measured at fair value:

Financial assets - derivatives (Note 23.1)

Forward currency contracts

- $US

December 31, 2014 1,193

-

1,193

-

Available-for-sale financial assets (Note 23.2)

Unlisted shares

Different sectors with

internet platforms

December 31, 2014

365

-

-

365

Financial assets available for sale are financial investments acquired by the Group throughout 2015. At year end, no

factors or evidence arose which lead us to consider that their fair value differs from the purchase price. At year-end

2016, the Group will analyze the above fair value in accordance with the corresponding measurement standard.

23.4. Information on the average payment period to suppliers.Third additional

provision:“Disclosure requirements” of Law 15/2010 of July 5.”

In accordance with the terms of the single additional provision of the Resolution of the Institute of Accounting and

Auditors of Accounts dated January 29, 2016 on information to be included in notes to the financial statements

regarding the average payment period to suppliers, the Group will only present the information for the year, rather than

comparative information; therefore, these are considered first-time consolidated financial statements for these exclusive

effects, with regard to the application of the uniformity principle and the comparability requirement.

Information on the average payment period to suppliers is as follows:

2015

(Days)

Average supplier payment period

77

Ratio of paid transactions

79

Ratio of transactions pending payment

68

(Thousands of euros)

Total payments made

569,799

Total future payments

96,449

This difference is notable when compared to the maximum stipulated by payment arrears regulations, and is exclusively

due to the rigorous control exercised by the Group with regard to mercantile and tax requirements to be met by

invoices received, meaning that they are not paid until the incidents detected have not been resolved. The Group

scrupulously meets its commitments with regard to legislation aimed at battling late payments.