186

MEDIASET ESPAÑA COMUNICACIÓN, S.A. AND SUBSIDIARIES

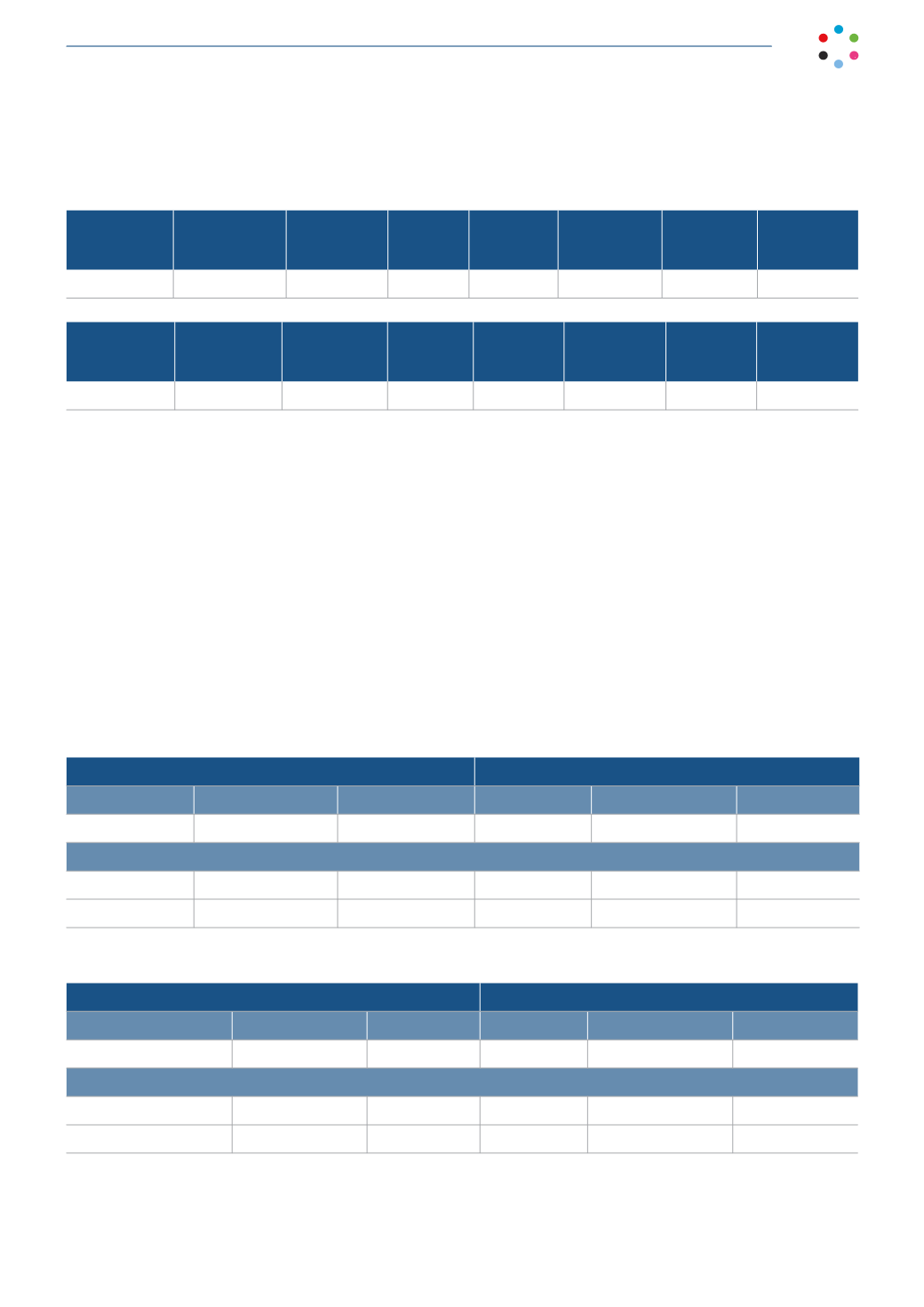

The sensitivity test shows that the impact of variations on the interest rates applied to the cash surpluses at December

31 would, in any event, not be significant and would exclusively affect the amount of financial income.

Reference rate

(%)

Cash

surpluses

Annual

interest

50 b.p.

Annual

interest

-20 b.p.

Annual

interest

12/31/15

-0.205%

192,405

(394)

0.295%

568

-0.405%

(779)

Reference

rate (%)

Cash

surpluses

Annual

interest

50 b.p.

Annual

interest

-10 b.p.

Annual

interest

12/31/14

0.018%

265,709

48

0.518%

1,316

-0.082%

(218)

23.6.6. Sensitivity analysis and estimates of the impact of changes in exchange rates on

the separate income statement.

The financial instruments exposed to euros/$ exchange-rate risk, mainly consisting of future currency-purchase

agreements, have undergone a sensitivity test at the statement of financial position date.

The exposed statement of financial position value of these financial instruments was corrected by applying a symmetrical

percentage change, equal to the 1-year implicit volatility of the currency in question published by Reuters (2015: 10.07%

and 2014: 8.910%), to the year-end exchange rate.

The sensitivity test shows that the variations on the year-end exchange rate would have had an impact on the Separate

income statement account that, in any event, is not significant.

Analysis of derivative assets in foreign currencies:

31/12/2015

31/12/2014

USD

Exchange rate

Differences

USD

Exchange rate

Differences

22,802

1.0887

865

21,026

1.2141

1,193

Sensibility analysis

22,082

1.1983

(976)

21,026

1.1059

2,880

22,082

0.9791

3,117

21,026

1.3223

(219)

Analysis of derivative liabilities in foreign currencies:

31/12/2015

31/12/2014

USD

Exchange rate

Differences

USD

Exchange rate

Differences

577

1.0887

(7)

393

1.2141

(16)

Sensibility analysis

577

1.1983

42

393

1.1059

(48)

577

0.9791

(66)

393

1.3223

10