181

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

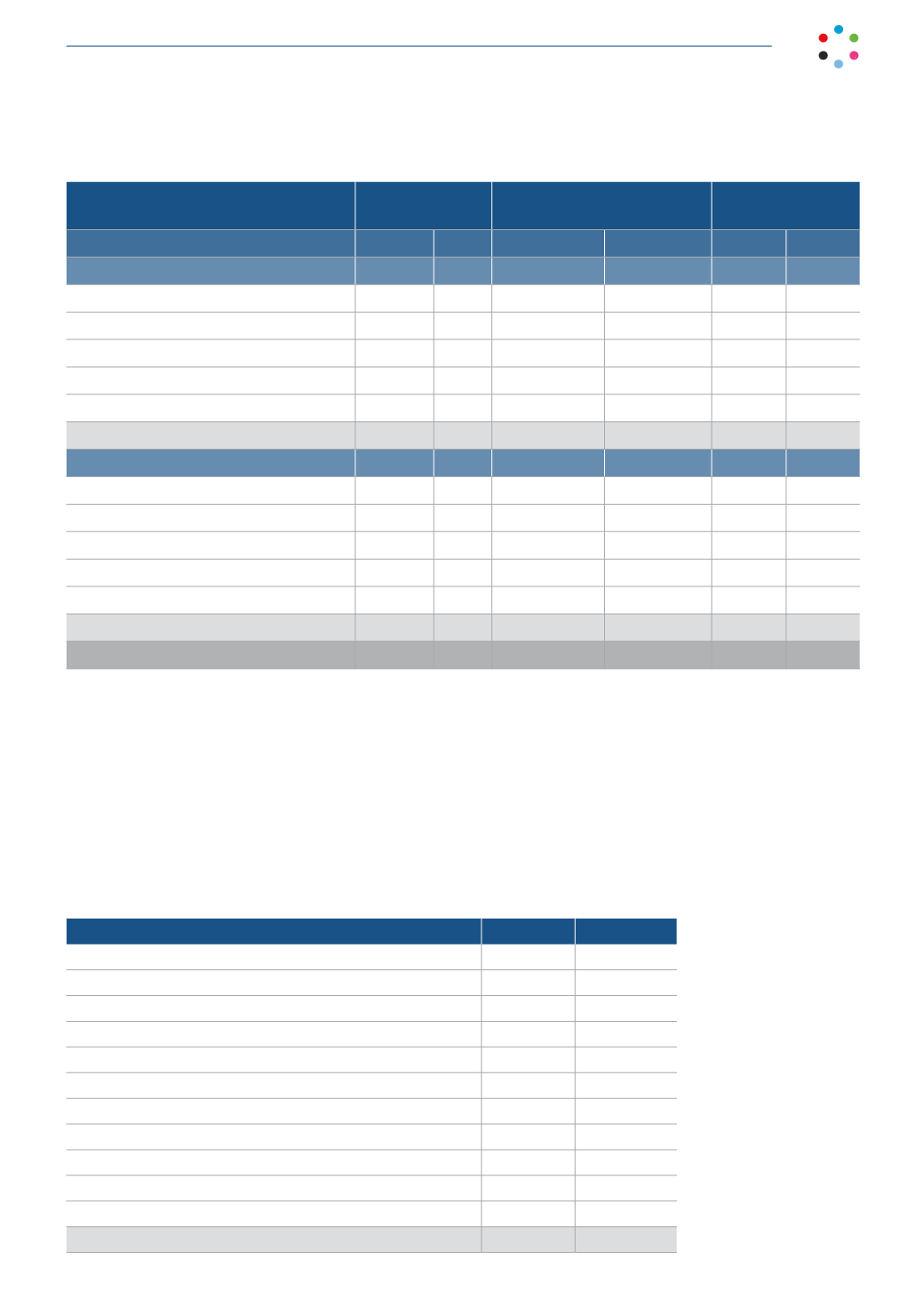

Thousands of euros

Bank borrowings

Payables, derivatives and other

financial assets

Total

2015 2014

2015

2014

2015

2014

Non-current financial liabilities

Trade and other payables

150

-

7,554

11,549

7,704 11,549

Liabilities at fair value through profit or loss

Held for trading

-

-

-

-

-

-

Others

-

-

Derivatives

-

-

-

-

-

-

TOTAL

150

-

7,554

11,549

7,704 11,549

Current financial liabilities

Trade and other payables

478 239

226,485

196,492 226,963 196,731

Liabilities at fair value through profit or loss

Held for trading

-

-

-

-

-

-

Others

-

-

-

-

-

-

Derivatives

-

-

7

16

7

16

TOTAL

478 239

226,492

196,508 226,970 196,747

628 239

234,046

208,057 234,674 208,296

At December 31, 2015, the Company had credit facilities amounting to 295,000 thousand euros.These bear interest at

EURIBOR plus a market spread in line with Group solvency. In 2014, existing credit facilities totaled 360,000 thousand

euro.These bear interest at IBOR plus a market spread in line with Group solvency.

The maturities of the 295,000 thousand euros of these credit facilities are distributed throughout 2016, and it is likely

they will be renewed at the amounts which are appropriate to operational needs, and at prices which are in line with

financial capacity and solvency.

At year-end 2015 and 2014 no amounts had been drawn down.

These financial liabilities are classified in the statement of financial position as follows:

2015

2014

Non-current borrowings from related parties (Note 17)

-

11,144

Non-current borrowings from third parties (Note 18)

7,380

-

Other non-current liabilities

324

405

Payable to related parties (Note 26.1)

25,034

18,243

Accounts payable for purchases and services

110,869

93,883

Accounts payable for audiovisual property rights

71,657

67,549

Bank borrowings

478

239

Current borrowings with third parties (Note 18)

1,061

-

Payables for non-current asset acquisitions

6,058

4,027

Remuneration payable

11,414

9,281

Other borrowings

399

3,526

234,674

208,296