178

MEDIASET ESPAÑA COMUNICACIÓN, S.A. AND SUBSIDIARIES

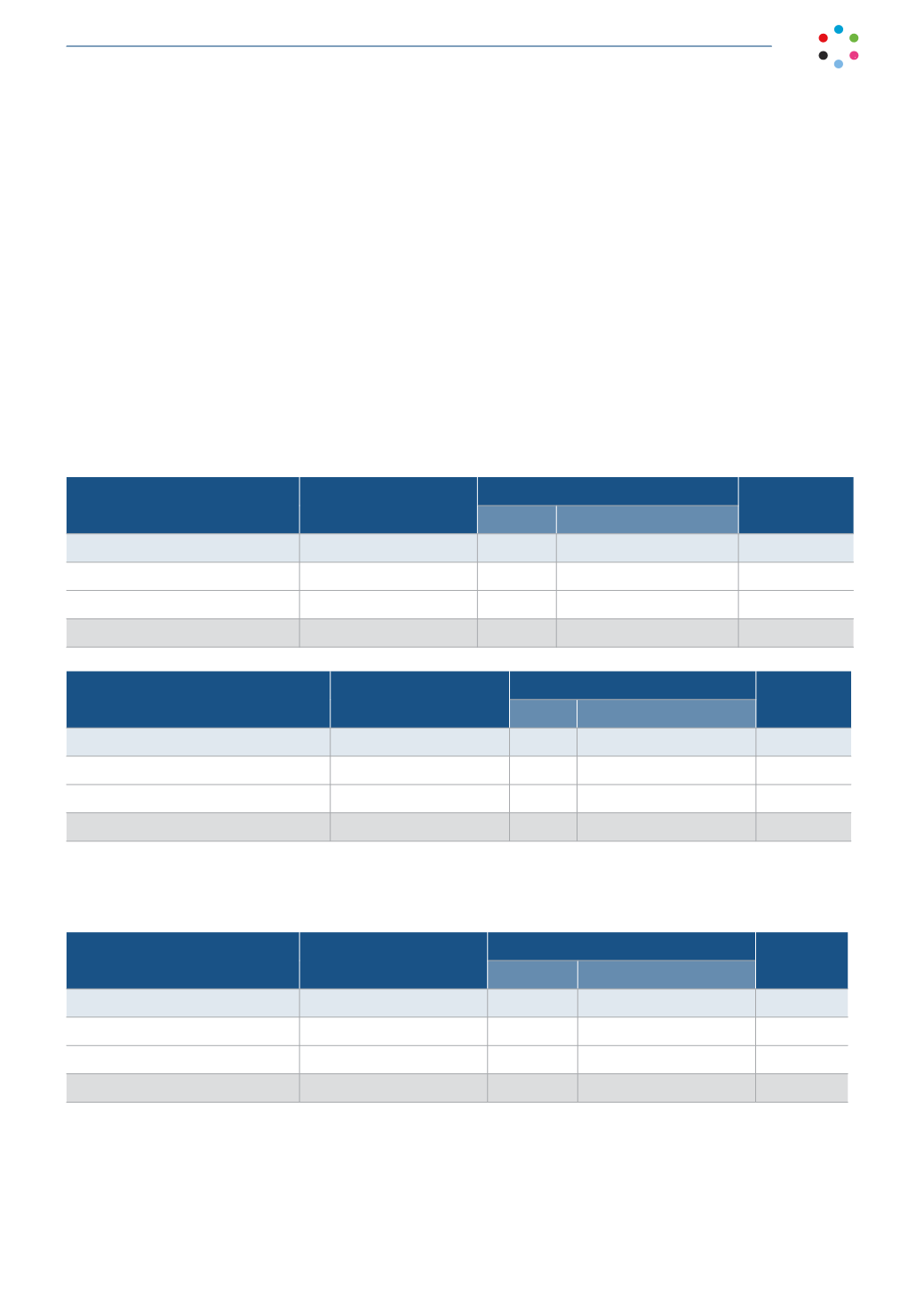

23. FINANCIAL INSTRUMENTS

23.1 Derivatives

The Group uses financial instruments to hedge the foreign currency risks relating to purchases of audiovisual property

rights in the year and, when necessary, to hedge those related to commercial transactions with customers, which are

recognized in the consolidated statement of financial position. As required by the corresponding measurement and

recognition policy, these derivatives are classified as “held for trading.”

The breakdown, by maturity, of the notional amounts of derivatives outstanding at the Group at December 31, 2015

and 2014 is as follows:

Derivative financial assets

2015

Notional amount/

Maturity up to one year

Amount in $

Fair value

(Note 23.2)

Dollars Year - end (€/$) exc. rate

Purchase of unmatured currency

Purchase of dollars in euros

19,336

22,082

1.0887

865

Sales of dollars in euros

-

-

-

-

Net

19,336

22,082

865

2014

Notional amount/

Maturity up to one year

Amount in $

Fair value

(Note 23.2)

Dollars Year - end (€/$) exc. rate

Purchase of unmatured currency

Purchase of dollars in euros

16,096

21,026

1.2141

1,193

Sales of dollars in euros

-

-

-

-

Net

16,096

21,026

1,193

Derivative financial liabilities

2015

Notional amount/ Maturity

up to one year

Amount in $

Fair value

Dollars

Year - end (€/$) exc. rate

Purchase of unmatured currency

Purchase of dollars in euros

-

-

-

-

Sales of dollars in euros

523

577

1.0887

(7)

Net

523

577

(7)