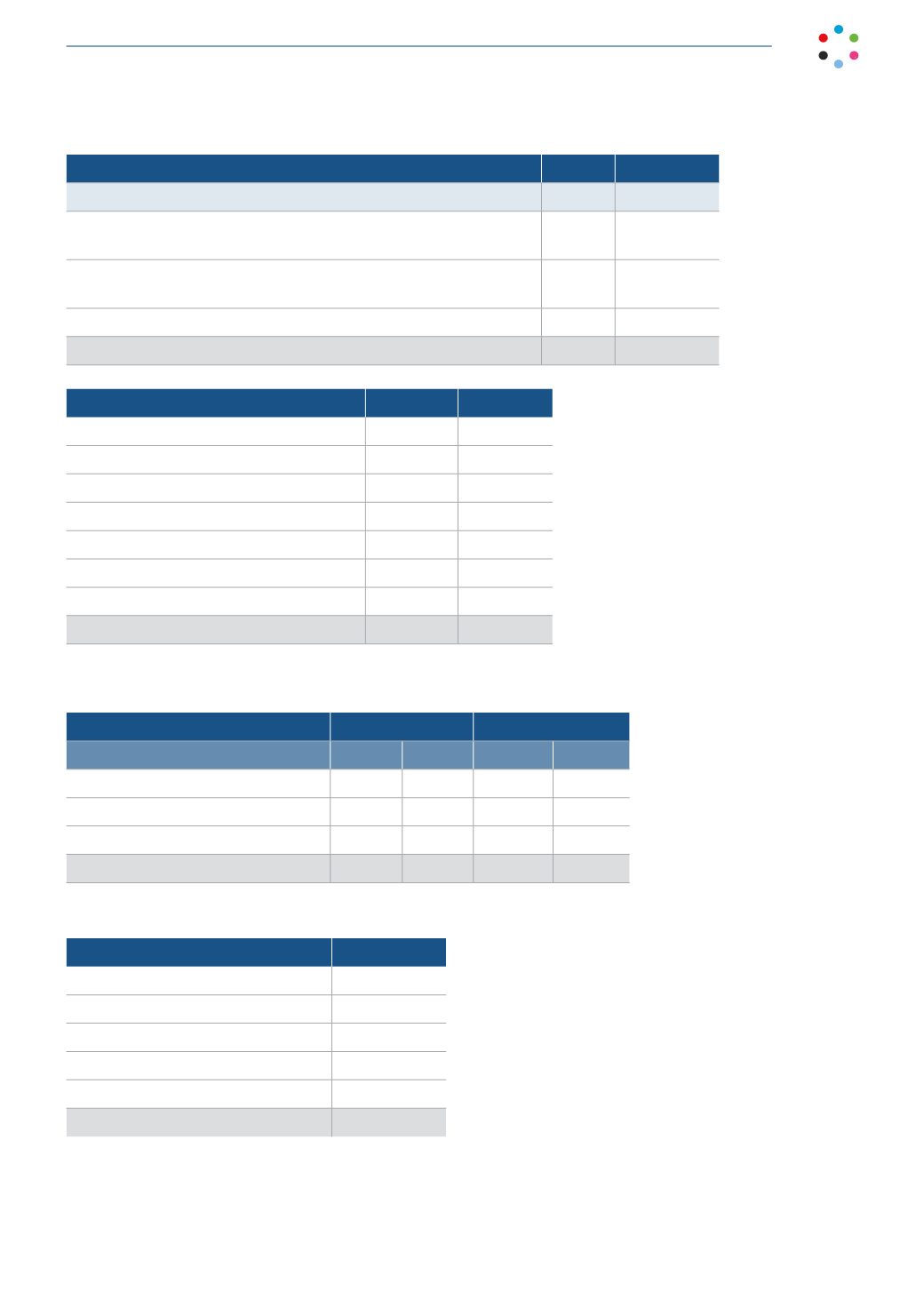

173

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

2015

2014

Consolidated statement of comprehensive income

Deferred taxes related to items recognized directly as other

comprehensive income

Net gain (loss) on disposal of assets arising from non-current

assets held for sale

-

(1,630)

Tax rate adjustment

-

109

Deferred taxes charged directly as other comprehensive income

-

(1,521)

2015

2014

Consolidated profit before tax

219,140

85,548

Tax rate

61,359

25,664

Permanent differences

1,283

(338)

Tax credits and rebates

1,117

(4,949)

Tax rate adjustment

(307)

14,372

Utilization of unused tax losses

(10,814)

(4,907)

Other

549

144

53,187

29,986

The reconciliation of net income and expenses for the year with tax results is as follows:

2015

2014

P&L

Equity

P&L

Equity

Consolidated profit before tax:

219,140

-

85,548

5,432

Permanent differences

4,582

-

(905)

-

Temporary differences

(69,232)

-

(19,210)

(5,432)

Taxable income

154,490

-

65,433

-

Income tax payable was calculated as follows:

2015

Taxable income

154,490

Tax payable (28%)

43,257

Utilization of unused tax losses

(10,814)

Deductions and rebates

(9,852)

Withholdings

(29,470)

Total income tax refund

(6,879)