175

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

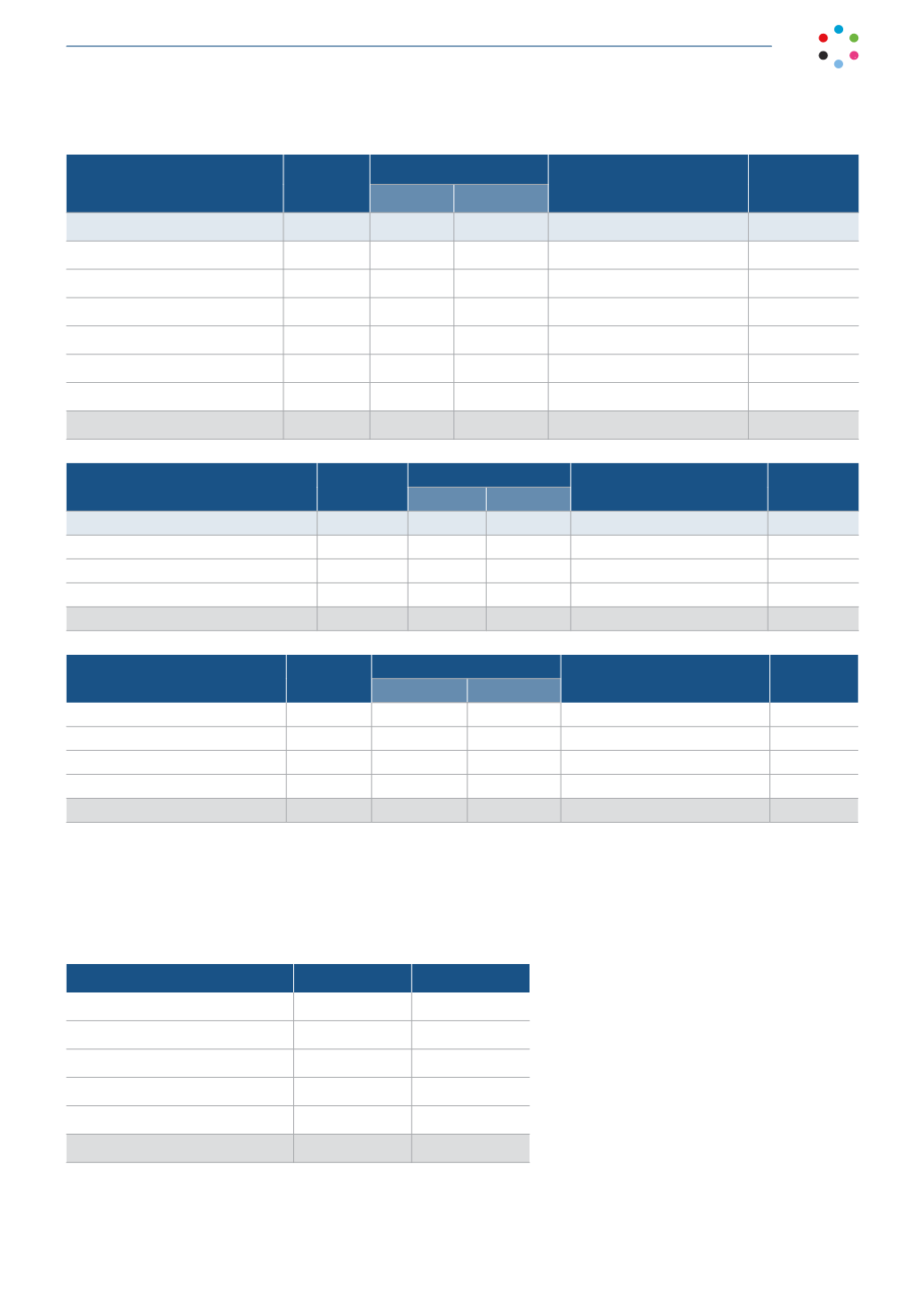

2014

Balance at

12/31/13

Income statement

Income and expenses

directly recognized in equity

Balance at

12/31/14

Increases Decreases

Deferred tax assets

Provision for litigation

571

63

-

-

634

Depreciation deductibility limit

15,121

11,865

-

-

26,986

Loss - investees

25,112

-

(19,929)

-

5,183

Other concepts

3,354

20

(1,089)

-

2,285

Unused tax deductions

46,490

7,444

-

-

53,934

Loss carryforwards

95,641

-

(19,881)

-

75,760

Total deferred tax assets

186,290

19,392

(40,899)

-

164,783

2015

Balance at

12/31/14

Income statement

Income and expenses

directly recognized in equity

Balance at

12/31/15

Increases Decreases

Deferred tax liabilities

Other items

7,203

1,282

(170)

-

8,315

Available-for-sale financial assets

1,521

-

(1,521)

-

-

Intangible assets

1,309

-

(1,309)

-

-

Total deferred tax liabilities

10,033

1,282

(3,000)

8,315

2014

Balance at

12/31/13

Income statement

Income and expenses directly

recognized in equity

Balance at

12/31/14

Increases

Decreases

Deferred tax liabilities

Other items

7,092

111

-

-

7,203

Available-for-sale financial assets

-

-

-

1,521

1,521

Intangible assets

2,792

-

(1,483)

-

1,309

Total deferred tax liabilities

9,884

111

(1,483)

1,521

10,033

Deferred tax liabilities on intangible assets arise from the deductibility of goodwill and the license acquired.

The unused tax credits mainly relate to tax credits for investments in film productions.These tax credits may be used

over the next 15 years.

Thousands of euros

2015

2014

Deductions pending 2011

6,308

14,355

Deductions pending 2012

18,199

21,518

Deductions pending 2013

7,322

7,322

Deductions pending 2014

10,739

10,739

Deductions pending 2015

8,938

-

51,506

53,934

The Group estimates the taxable profits which it expects to obtain over the next fiscal years. It has likewise analyzed the

reversal period of taxable temporary differences. Based on this analysis, the Group has recognized deferred tax assets

for tax credits and deductible temporary differences which it considers probable will be recoverable in the future.