179

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

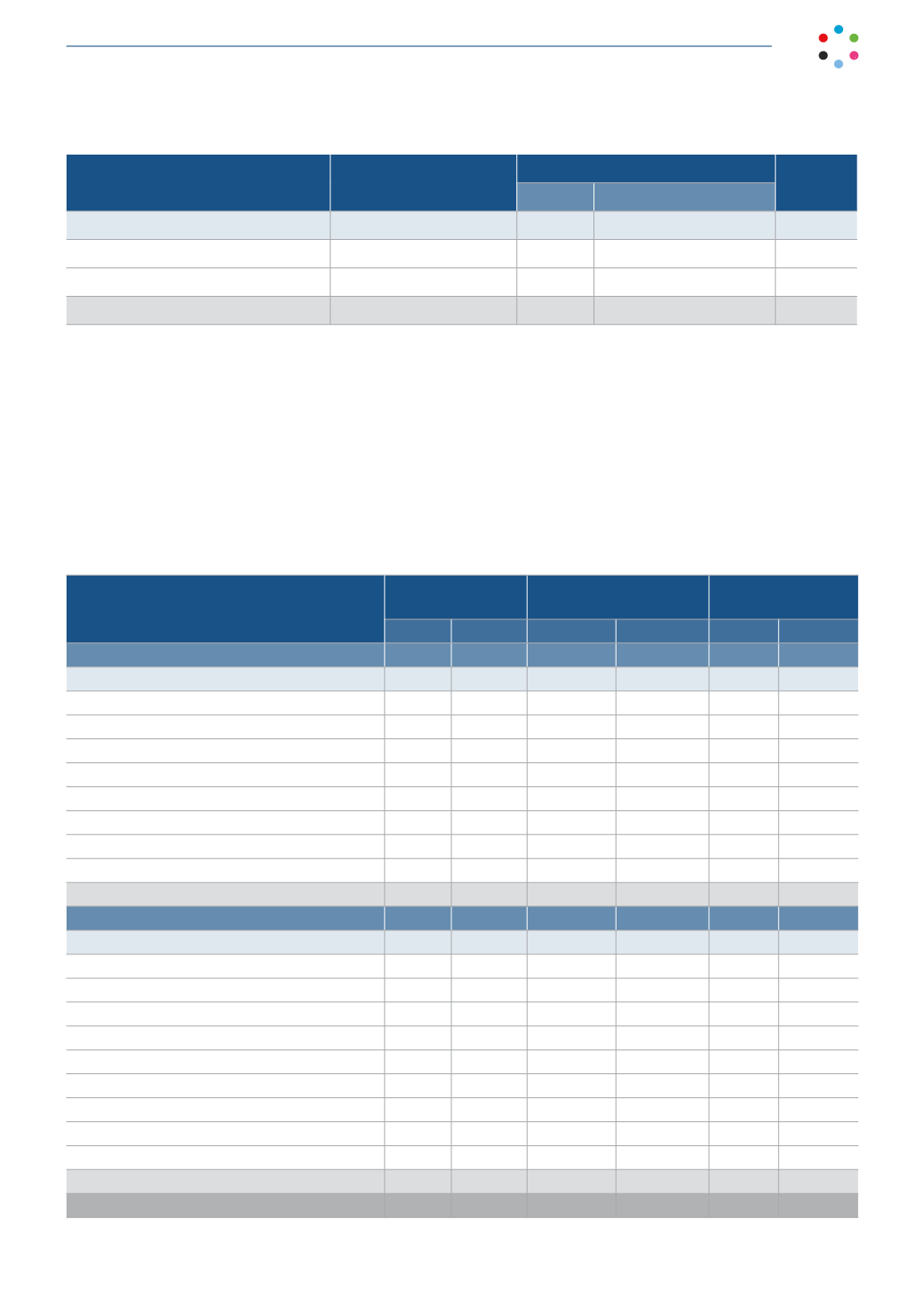

2014

Notional amount/

Maturity up to one year

Amount in $

Fair value

Dollars Year - end (€/$) exc. Rate

Purchase of unmatured currency

Purchase of dollars in euros

-

-

-

-

Sales of dollars in euros

307

393

1.2141

(16)

Net

307

393

(16)

The foreign currency derivatives associated with the property rights are measured at the difference between the

present value of the quoted foreign currency hedge at the forward exchange rate in the contract and the value of the

quoted foreign currency hedge at year end.

23.2. The classification of financial assets and liabilities per the categories

established in IFRS would be as follows:

Thousands of euros

Equity instruments

Loans, derivatives and

other financial assets

Total

2015

2014

2015

2014

2015

2014

Non-current financial assets

Assets at fair value through profit or loss

Held for trading

-

-

-

Other

-

-

-

Held-to-maturity investments

-

-

-

Loans and receivables

-

5,419

5,984 5,419

5,984

Available-for-sale financial assets

Measured at fair value

9,394

365

-

-

9,304

365

Measured at cost

-

-

-

-

-

-

Derivatives

-

-

-

-

-

-

TOTAL

9,394

365

5,419

5,984 14,813

6,349

Current financial assets

Assets at fair value through profit or loss

Held for trading

-

-

-

-

-

-

Other

-

-

-

-

-

-

Held-to-maturity investments

-

-

-

-

-

-

Loans and receivables

-

-

226,561

203,995 226,561 203,995

Available-for-sale financial assets

Measured at fair value

-

-

-

-

-

-

Measured at cost

-

-

-

-

-

-

Assets held for sale

-

7,933

-

-

-

7,933

Derivatives

-

-

865

1,193

865

1,193

TOTAL

-

7,933 227,426

205,188 227,426 213,121

TOTAL

9,394 8,298

232,845

211,172 242,239 219,470