182

MEDIASET ESPAÑA COMUNICACIÓN, S.A. AND SUBSIDIARIES

There are no significant differences between the fair value and the net carrying amounts of financial assets and liabilities

at December 31, 2015 and 2014.

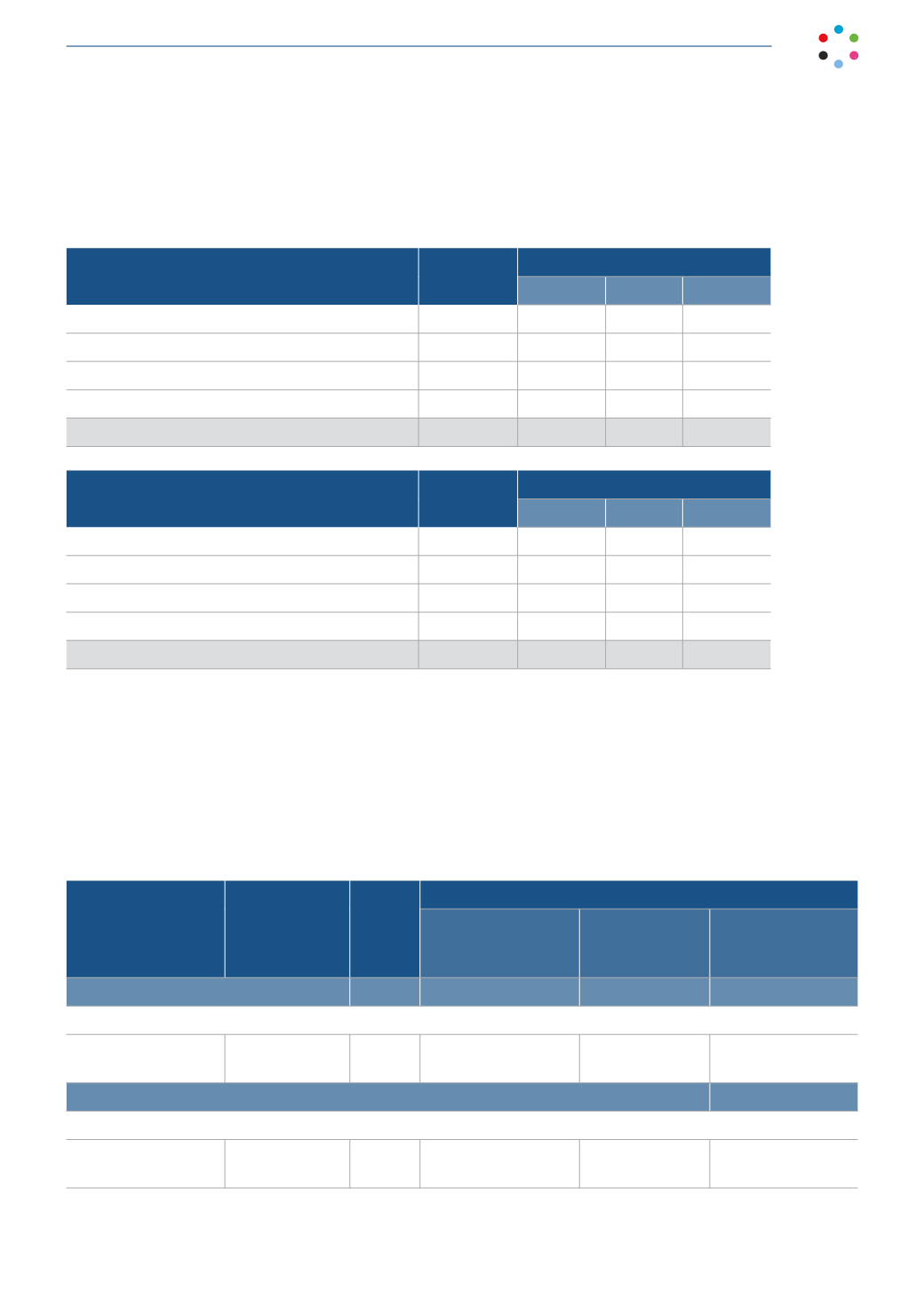

The maturity of the principal financial instruments is as shown in the following table (in thousands of euros):

2015

Balance

Maturities

3 months 6 months 12 months

Accounts payable for purchases and services

110,869 110,817

52

-

Accounts payable for audiovisual property rights

71,657

71,309

318

30

Bank borrowings

478

478

-

-

Payables for non-current asset acquisitions

6,058

6,044

14

-

Total

189,062 188,648

384

30

2014

Balance

Maturities

3 months 6 months 12 months

Accounts payable for purchases and services

93,883

89,258

4,625

-

Accounts payable for audiovisual property rights

67,549

65,027

2,522

-

Bank borrowings

239

237

-

2

Payables for non-current asset acquisitions

4,027

3,880

147

-

Total

165,698 158,402

7,294

2

The maturities of the borrowings from related parties are shown in detail in Note 26.1.

23.3. Measurement at fair value

The following table reflects the fair value hierarchy of the Group’s assets.

Breakdown of the fair value of the Group’s assets in 2015:

Thousands of euros

Measurement

date

Total

Fair value measurement used

Listed value on active

markets (Level 1)

Significant

observable values

(Level 2)

Significant non-

observable values

(Level 3)

Assets measured at fair value:

Financial assets - derivatives (Note 23.1)

Forward currency

contracts - $US

December 31,

2015

865

-

865

-

Available-for-sale financial assets (Note 23.2)

Unlisted shares

Different sectors with

internet platforms

December 31,

2015

9,394

-

-

9,394