172

MEDIASET ESPAÑA COMUNICACIÓN, S.A. AND SUBSIDIARIES

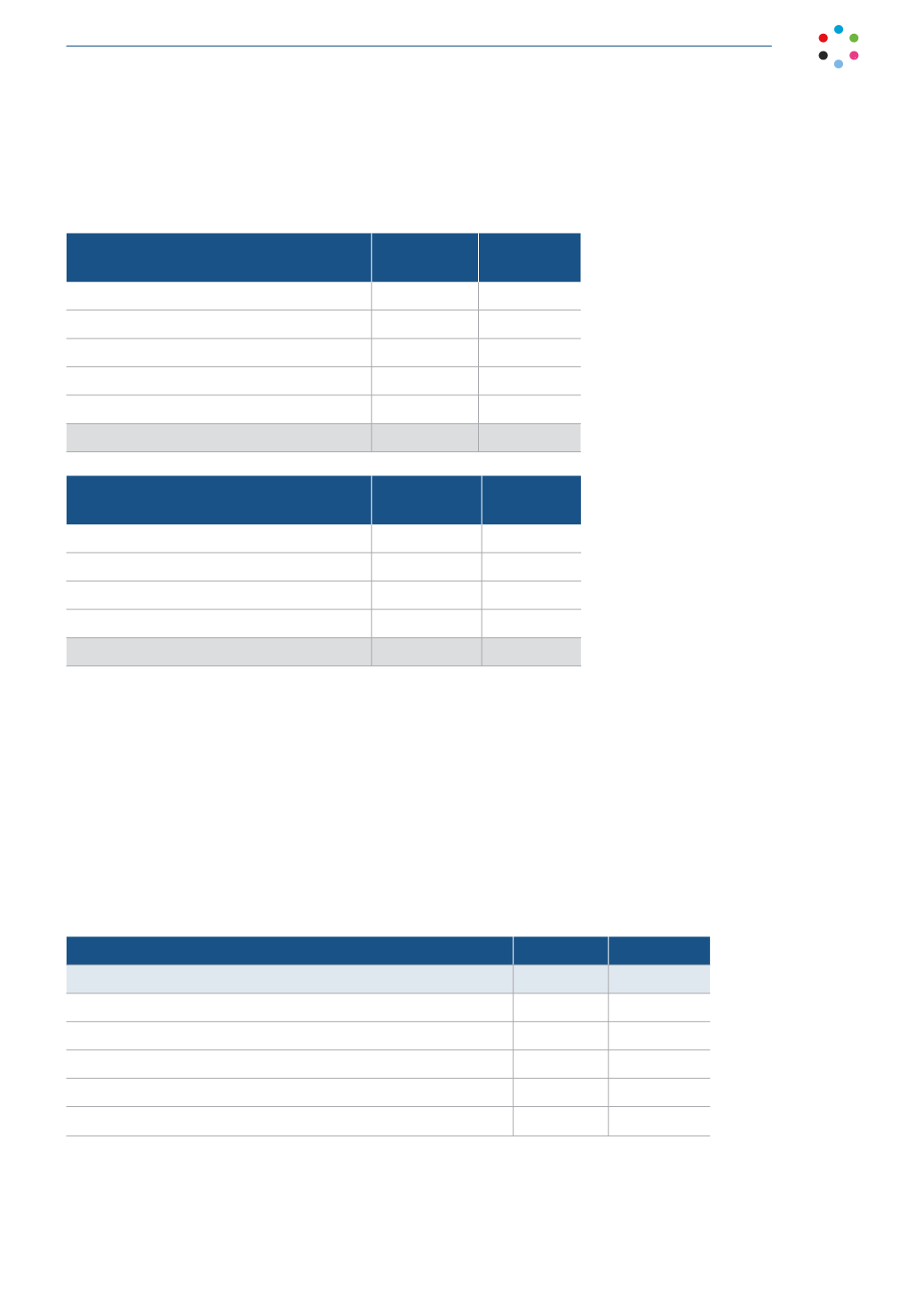

20.3. Balances relating to Public Authorities

The breakdown of balances relating to Public Authorities is as follows:

Balance at

12/31/15

Balance at

12/31/14

Deferred tax liabilities

8,316

10,033

Value added tax liability

10,814

16,729

Personal income tax withholdings

2,691

3,315

Payable to Social Security

1,563

1,559

Other public entities

7,440

8,177

Payable to tax authorities

22,508

29,780

Balance at

12/31/15

Balance at

12/31/14

Deferred tax assets

134,507

164,783

Income tax receivable

9,424

12,459

Value added tax receivable

7,633

7,652

Other tax receivables

7

7

Receivable from tax authorities

7,640

7,659

As a result of Law 8/2009 on the Financing of Radio Televisión Española and the definitive procedure for calculating,

declaring, and paying the amount developed in Royal Decree 1004/2010 of August 5, which implemented Law 8/2009

and ITC order/2373/2010 of September 9, approving the statements and prepayments set out in Law 8/2009, the

amount corresponding to 3% of the Company’s gross operating income billed is recognized under “Other public

entities.” At December 31, 2015, the outstanding balance is 6,529 thousand euros (2014: 7,592 thousand euros). The

differences in the balance payable are due to the higher amount of payments on account in 2015 vs 2014.

20.4. Income tax

The detail of the calculation of the income tax expense/(income) is as follows:

2015

2014

Consolidated separate income statement

Current income tax

Current income tax expense

24,628

9,851

Change in deferred tax assets and liabilities

Relating to increases and decreases in temporary differences

28,559

20,135

53,187

29,986