77

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

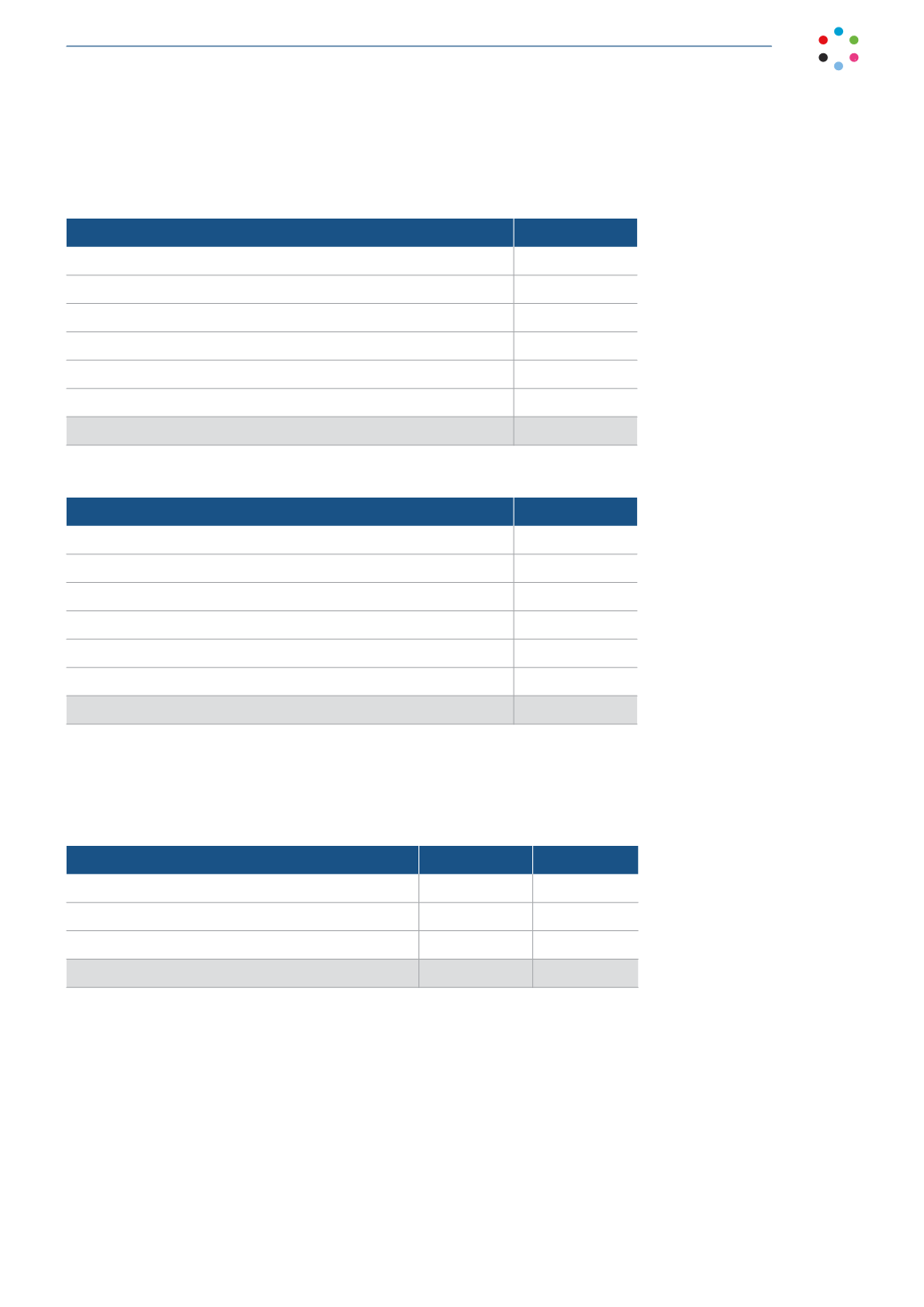

Income tax payable was calculated as follows:

Thousands of euros

2015

Taxable income:

64,441

Tax payable: (28%)

18,043

Tax payable contributed by subsidiaries in tax consolidation

25,214

Deductions and rebates, companies filing consolidated taxes

(9,851)

Utilization of unused tax losses - consolidated companies

(10,814)

Withholdings

(29,471)

Total income tax refund

(6,879)

Thousands of euros

2014

Taxable income:

(25,136)

Tax payable: (30%)

-

Tax payable contributed by subsidiaries in tax consolidation

19,630

Deductions and rebates, companies filing consolidated taxes

(4,949)

Utilization of unused tax losses - consolidated companies

(4,907)

Withholdings

(12,328)

Total income tax refund

(2,554)

Refundable Income tax is as follows:

Thousands of euros

2015

2014

Corporate income tax refundable, 2013

-

9.905

Corporate income tax refundable, 2014

2,524

2,554

Corporate income tax refundable, 2015

6,879

-

Total

9,403

12,459