78

MEDIASET ESPAÑA COMUNICACIÓN, S.A.

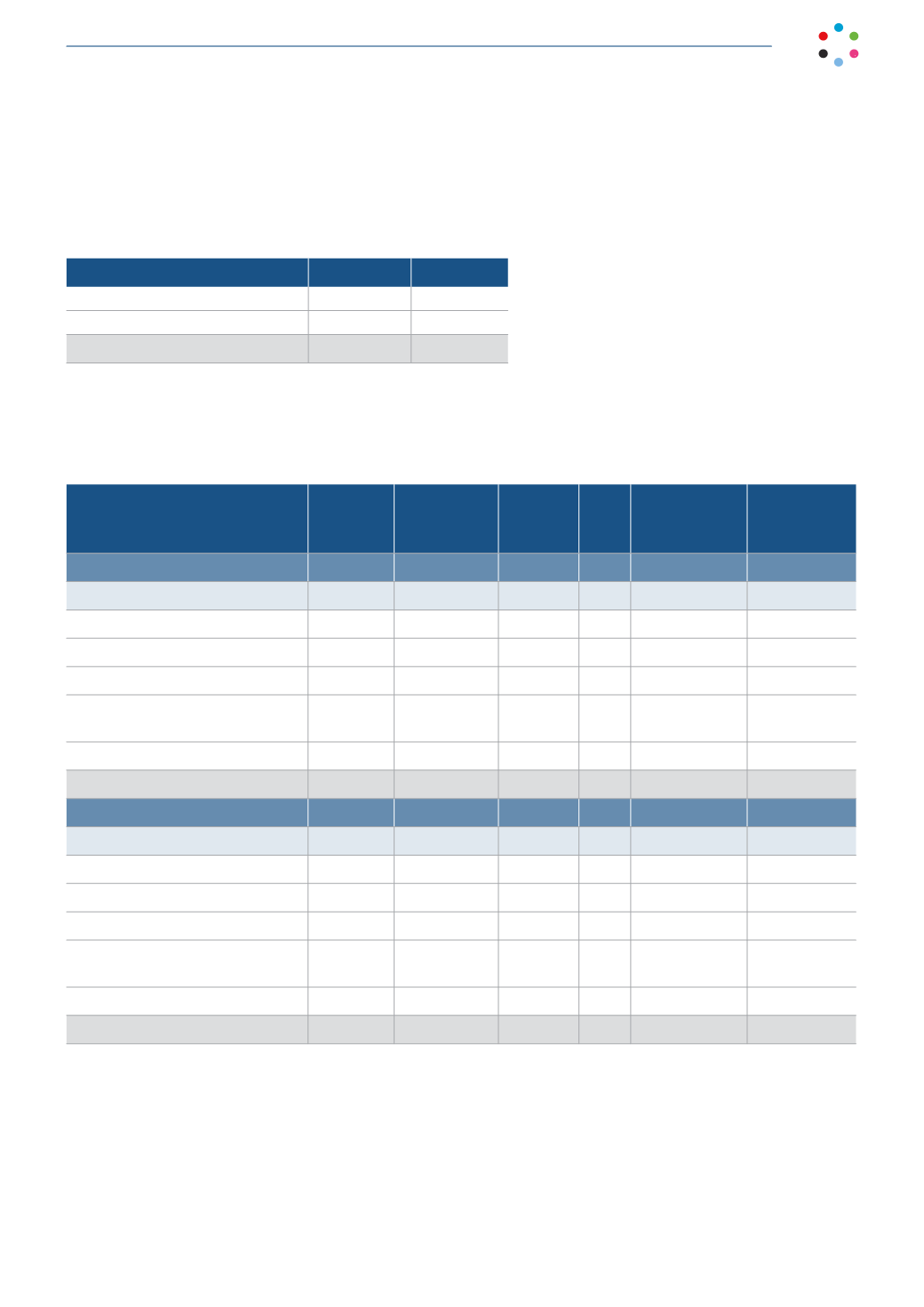

15.2 Deferred tax assets

The breakdown is as follows

Thousands of euros

2015

2014

Deferred tax assets

16,226

32,351

Unused tax credits and rebates

52,958

54,076

69,184

86,427

The changes in the items composing “Deferred tax assets” are as follows:

Thousands of euros

Balance at

January 1,

Adjustment

due to changes

in tax rates

Income

statement

Equity Reclassifications

Balance at

December 31,

2015

Deferred tax assets

Impairment audiovisual rights

1,018

-

2,125 -

-

3,143

Rights management institutions

634

-

172 -

-

806

Provisions, subsidiaries

4,018

-

90 -

-

4,108

Tax deductibility of depreciation/

amortization

24,086

-

(19,065)

-

-

5,021

Other provisions

2,595

(5)

558 -

-

3,148

32,351

16,226

2014

Deferred tax assets

Impairment audiovisual rights

1,475

(72)

(385)

-

-

1,018

Rights management institutions

571

(127)

190 -

-

634

Provisions, subsidiaries

23,815

(570)

(19,227)

-

-

4,018

Tax deductibility of depreciation/

amortization

13,921

-

10,165 -

-

24,086

Other provisions

2,743

(510)

362 -

-

2,595

42,525

(1,279)

(8,895)

-

-

32,351

During 2015, the tax group recognized deferred tax assets for unused tax loss carryforwards amounting to 37,470

thousand euros (2014: 15,379 thousand euros).

At December 31, there were deferred tax assets for unused tax loss carryforwards totaling 259,949 thousand euros

(2014: 297,419 thousand euros).

At December 31, 2015 unused tax credits for audiovisual productions amount to a total of 52,957 thousand euros

(2014: 54,076 thousand euros) which can be recovered over the next 15 years.