73

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

Value Added Tax

In 2010, the Company has filed consolidated tax as regulated by Chapter IX,Title IX of Law 37/1992. As a result, it has

presented consolidatedVAT for tax group 0092/10, which comprises:

• Mediaset España Comunicación, S.A., as the parent

• Telecinco Cinema, S.A.U.

• Publiespaña, S.A.U.

• Mediacinco Cartera, S.L.

Presenting consolidatedVAT generates a short-term payable to Group companies for the tax effect (Note 19).

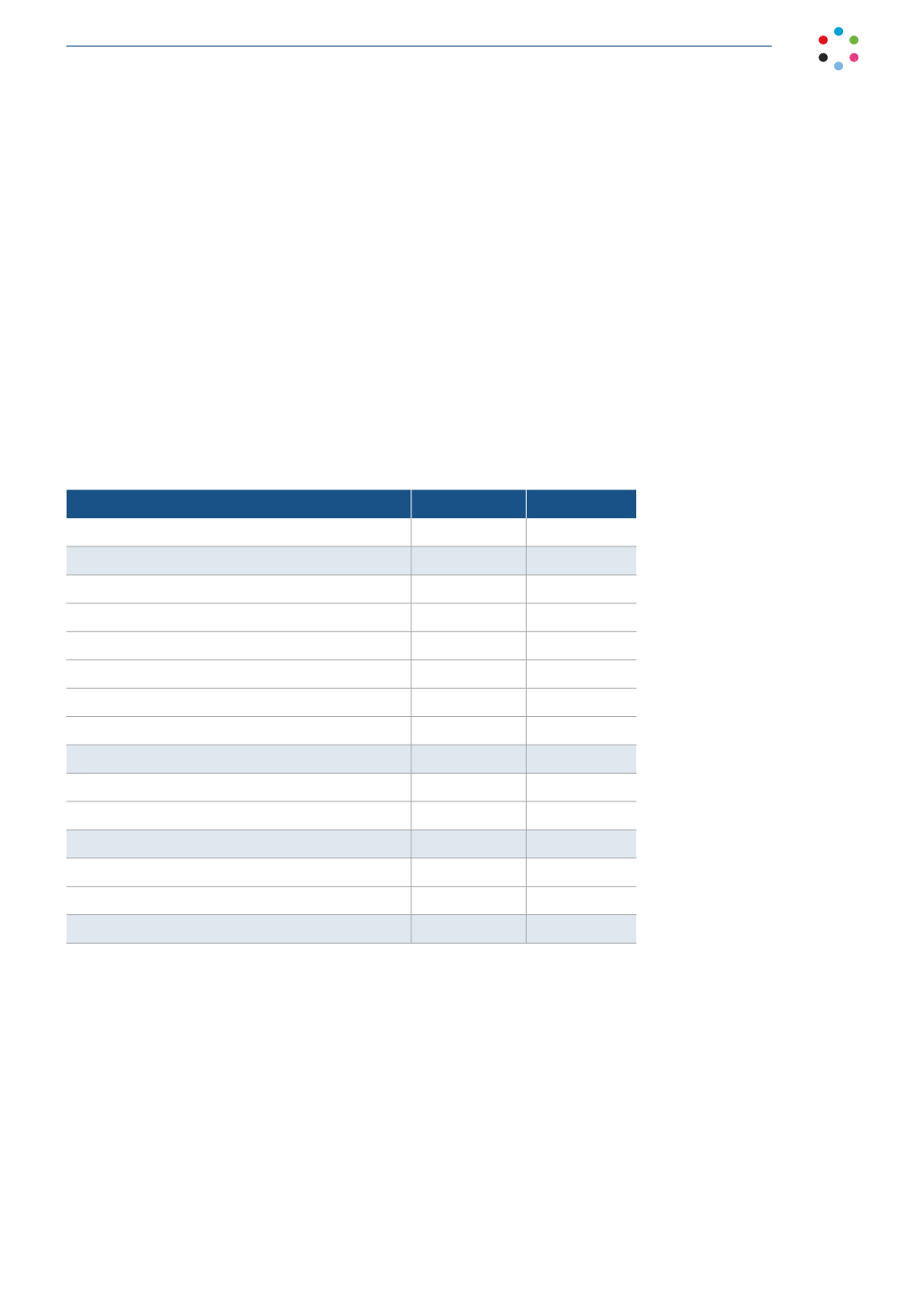

The breakdown of balances relating to income tax assets and liabilities at December 31 is as follows:

Thousands of euros

2015

2014

Deferred tax liabilities

(7,675)

(8,649)

Deferred tax liabilities

(7,675)

(8,649)

VAT

(9,582)

(15,491)

Personal income tax withholdings

(2,216)

(2,694)

Social security

(1,235)

(1,253)

Levy to finance RTVE

(6,529)

(7,592)

Public radio spectrum tax

(11)

-

Others

(54)

-

Other payables to public administrations

(19,627)

(27,030)

Deferred tax assets

16,226

32,351

Unused tax deductions and relief

52,958

54,076

Deferred tax assets

69,184

86,427

Income tax

9,403

12,459

Personal income tax withholdings - leases

10

-

Income tax

9,413

12,459