79

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

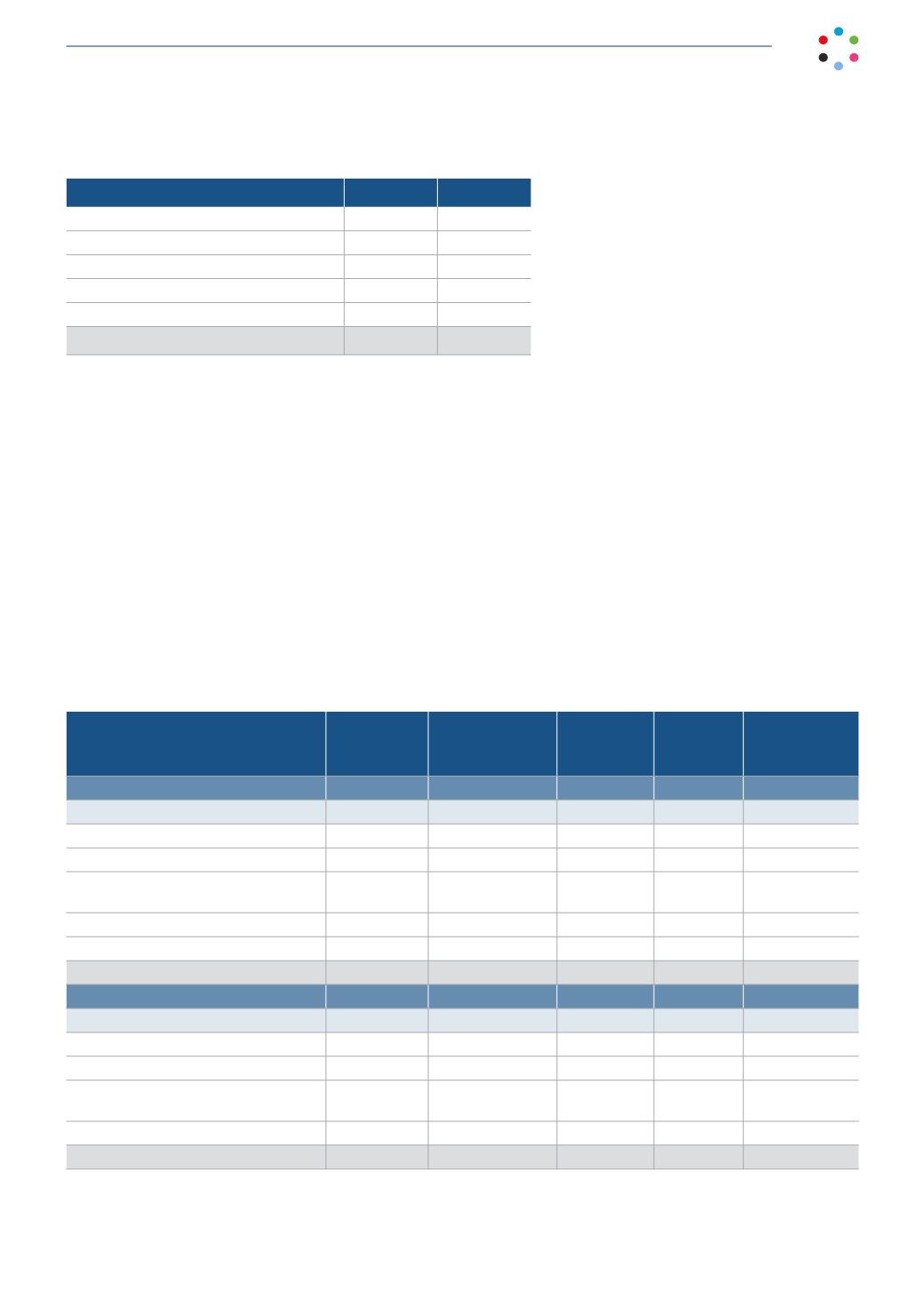

Thousands of euros

2015

2014

Deductions pending 2011

6,318

14,356

Deductions pending 2012

19,501

19,501

Deductions pending 2013

7,060

7,060

Deductions pending 2014

11,140

13,159

Deductions pending 2015

8,939

-

52,958

54,076

The Company has availed itself of the deduction provided for in article 42 of Royal Legislative Decree 4/2004, of March

5, which enacted the revised text of the Corporation Tax Law, in respect of income of 1,637 thousand euros. This

amount was generated by the sale of 60% of the Company’s ownership in Cinematext Media, S.A., which was sold on

September 30, 2009.

The Company estimated the taxable profits which it expects to obtain over the next years. It has likewise analyzed the

reversal period of taxable temporary differences. Based on this analysis, the Company has recognized deferred tax assets

for tax credits and deductible temporary differences which it considers probable will be recoverable in the future.

15.3 Deferred tax liabilities

The breakdown and movements in the various items composing “Deferred tax liabilities” are as follows:

Thousands of euros

Opening

balance at

January 1,

Adjustment due

to changes in tax

rates

Income

statement

Equity

Closing

balance at

December 31,

2015

Deferred tax liabilities

Other

1,079

64

(799)

-

344

Tax amortization of goodwill

3,804

-

806

-

4,610

Tax amortization of signal

transmission license

2,245

-

476

-

2,721

Available-for-sale financial assets

1,521

-

-

-

1,521

Available-for-sale financial assets

-

-

-

(1,521)

(1,521)

8,649

64

483

(1,521)

7,675

2014

Deferred tax liabilities

Other

2,791

(229)

(1,483)

-

1,079

Tax amortization of goodwill

3,528

(588)

864

-

3,804

Tax amortization of signal

transmission license

2,082

(347)

510

-

2,245

Available-for-sale financial assets

-

-

-

1,521

1,521

8,401

(1,164)

(109)

1,521

8,649

The deferred tax liability mainly relates to taxable temporary differences arising from consolidation adjustments of the

tax group and tax amortization of intangible assets with an indefinite useful life (goodwill and signal transmission license).