75

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

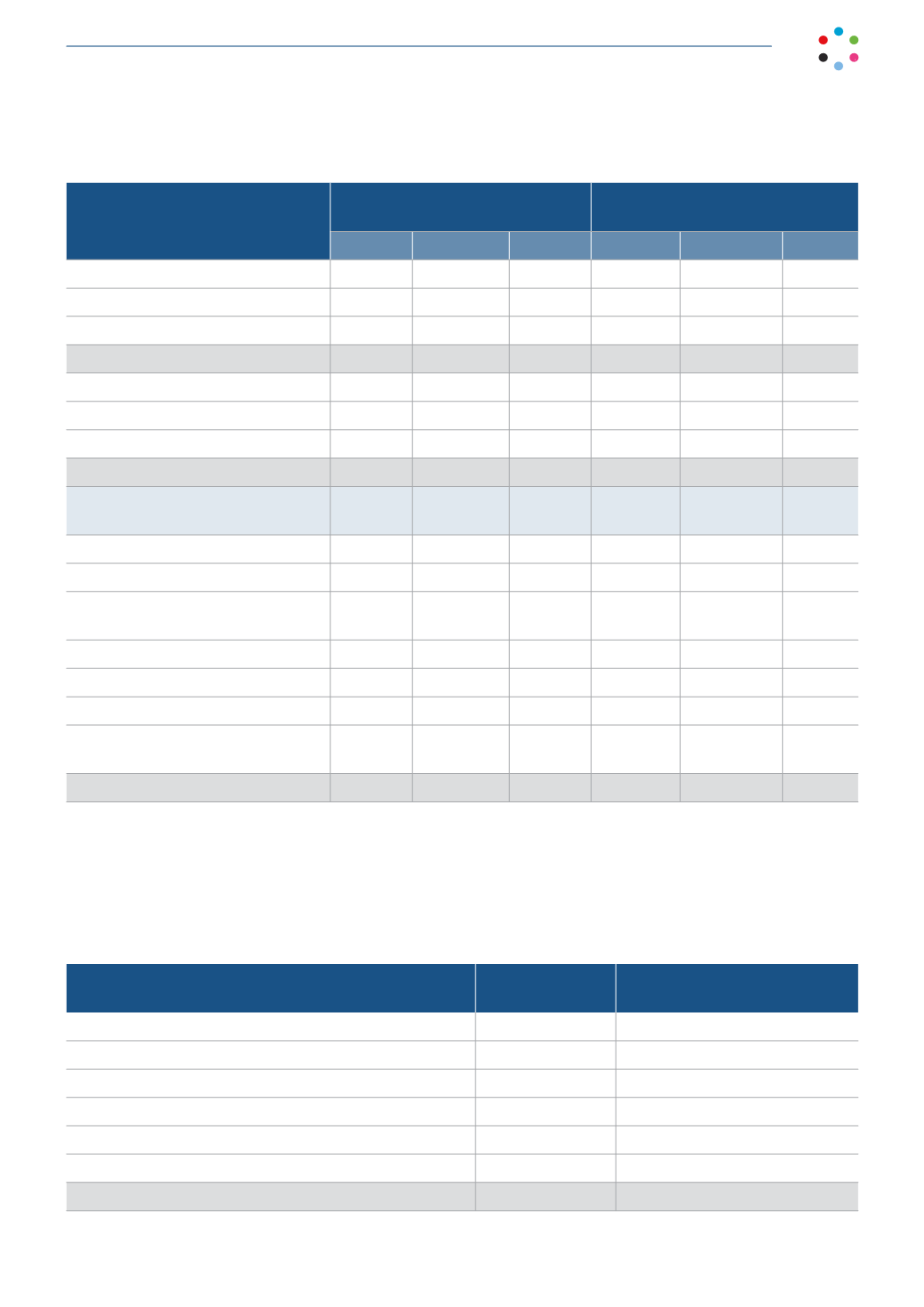

Thousands of euros

2014

Income statement

Income and expenses directly

recognized in equity

Increase Decrease

Total

Increase

Decrease

Total

Income and expenses for the year

Continuing operations

59,963

-

59,963

3,911

-

3,911

Discontinued operations

-

-

-

-

-

-

59,963

-

59,963

3,911

-

3,911

Income tax

Continuing operations

11,954

-

11,954

-

(1,521)

(1,521)

Discontinued operations

-

-

-

-

-

-

11,964

-

11,964

-

(1,521)

(1,521)

Income and expenses for the year

before tax

48,009

5,432

Permanent differences

Provisions - group companies

3,348

-

3,348

-

-

-

Non-deductible expenses

& penalties

259

-

259

-

-

-

Internal elimination of dividends

-

(56,126)

(56,126)

-

-

-

Others

-

(1,412)

(1,412)

-

-

-

Temporary differences

-

(19,214)

(19,214)

-

(5,432)

(5,432)

Utilization of previously unrecognized

tax losses

-

-

-

-

-

-

Tax result

(25,136)

-

Temporary differences are due to different taxation and accounting criteria relative to impairment provisions regarding

audiovisual rights and provisions for subsidiaries.

The reconciliation between income tax expense/(income) and the result of multiplying total recognized income and

expenses by applicable tax rates —with the balance of the income statement being differentiated— is as follows:

Thousands of euros

2015

Income statement

Income and expense recognized

directly in equity

Income and expenses for the year before tax

195,380

-

Tax charge (tax rate: 30%)

54,707

-

Non-deductible expenses (revenue)

(19,769)

-

Tax credits and others

(7,137)

-

Tax on foreign profits

116

-

Adjustments due to changes in tax rates

59

-

Tax expense (income)

27,976

-