72

MEDIASET ESPAÑA COMUNICACIÓN, S.A.

15. TAXES

Under prevailing tax regulations, tax returns may not be considered final until they have either been inspected by tax

authorities or until the four-year inspection period has expired.The Company is open to inspection of all taxes to which

it is liable for the last four years.

On January 13, 2016, notification was received from the SpanishTax Authorities and customs control department of the

central office of major taxpayers that a tax inspection proceeding had been opened for the following items and years

open to inspection:

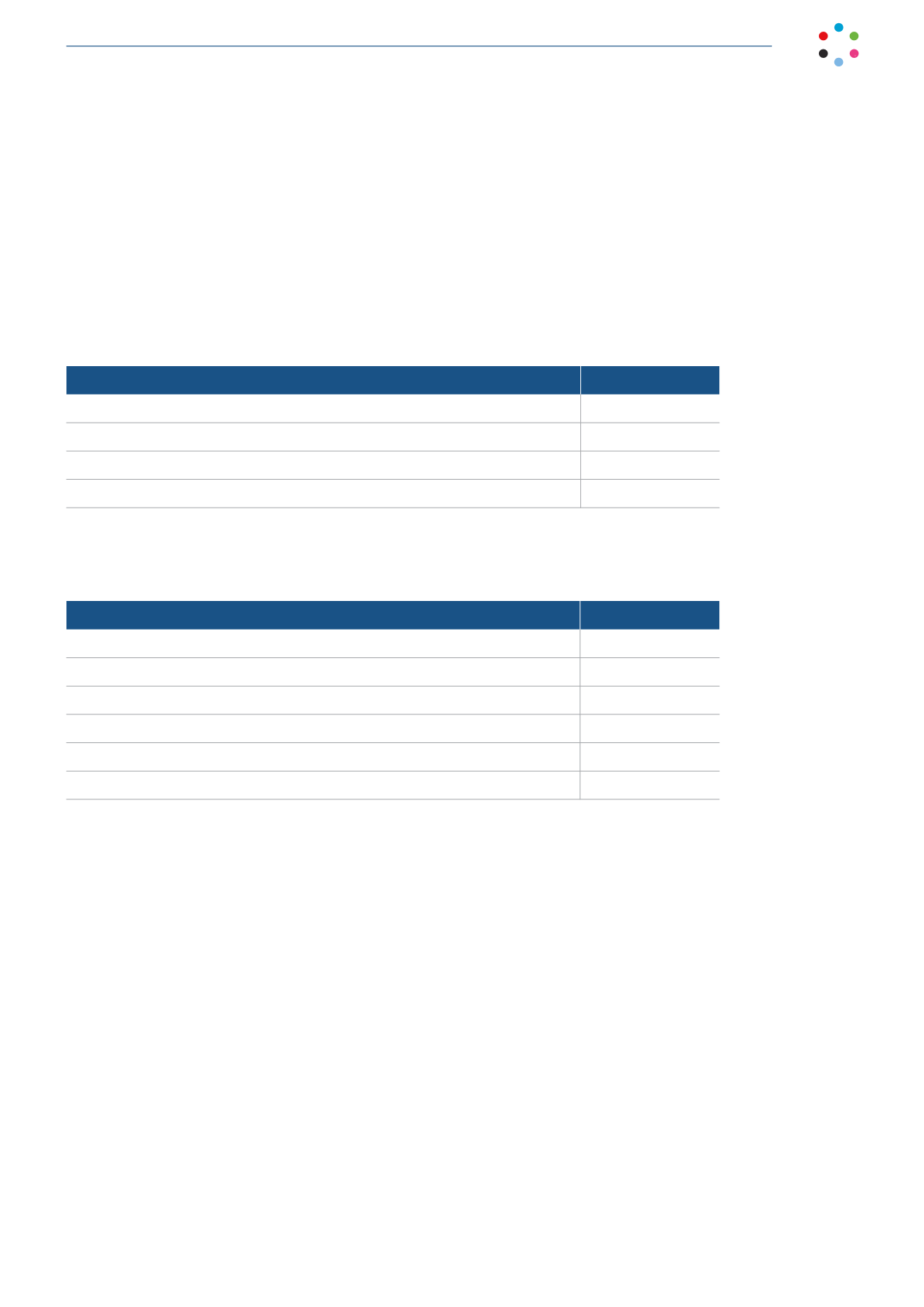

Item(s)

Periods

Income tax

2011 a 2014

Value added tax

2012 a 2014

Withholdings/Payments on account/Professionals

2012 a 2014

Withholding, non-resident income tax

2012 a 2014

February 9, 2016 was set for the first appearance.

The following Company items and periods are open to inspection:

Item(s)

Periods

Income tax

2011 a 2014

Value added tax

2012 a 2015

Withholding, non-resident income tax

2012 a 2015

Gaming tax (*):

Until June 2012

Annual transaction statement

2011 a 2015

Consolidated statement of intra-regional delivery and acquisition of assets

2012 a 2015

(*) Commencing this date, this activity is carried out by another group company

In 2013 the verification procedures carried out by the Spanish Tax Authorities’Tax and Customs Control Department

of the Central Office of MajorTaxpayers on the following items finalized:“Taxes on games of luck, bets, or chance: raffles

and tombolas” as well as “Gaming tax: bets and promotional draws” for June, 2008 to December 2011. Assessments

raised totaling 9,029 thousand euros (Note 16) and the proposed settlement refer to Company transactions carried

out in close observance of the criteria established by the tax authorities (more specifically the inspectors) arising from

previous inspections and related to the same items and transactions identical in nature, and therefore, the parent’s

directors and tax advisors consider, there are solid arguments in the Company’s defense for applying the above criteria

in both lawsuits and appeals, and consequently obtaining a favorable result.

Based on the best interpretation of current legislation, the Company’s Directors and tax advisors consider that no

significant tax contingencies would arise as a result of varying interpretations of the tax legislation applicable to the

Company’s transactions.Therefore, the accompanying balance sheet does not include a provision for tax contingencies.