76

MEDIASET ESPAÑA COMUNICACIÓN, S.A.

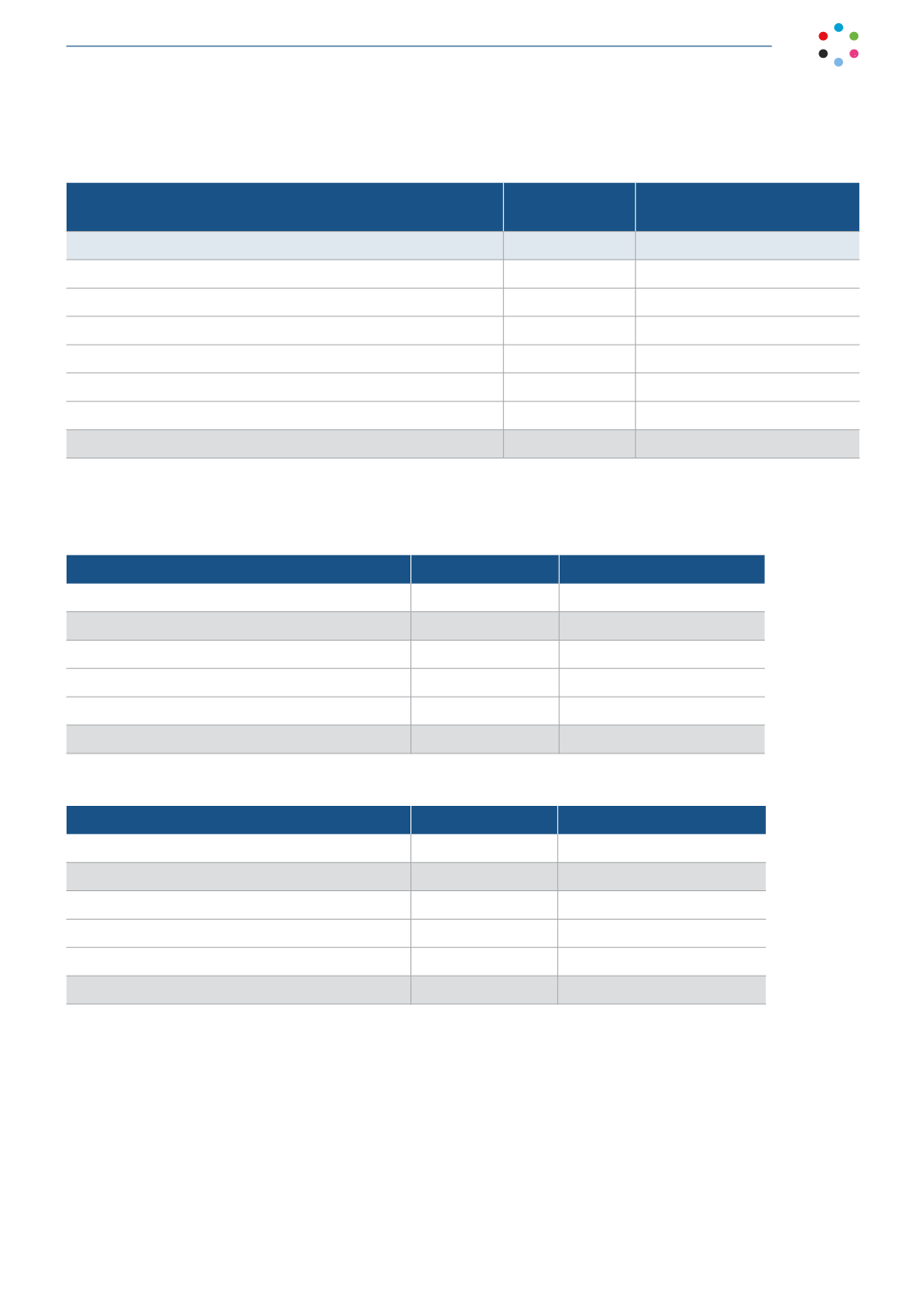

Thousands of euros

2014

Income statement

Income and expense recognized

directly in equity

Income and expenses for the year before tax

48,009

5,432

Tax charge (tax rate: 30%)

14,403

1,521

Non-deductible expenses (revenue)

(16,195)

-

Tax credits and others

(10,236)

-

Tax adjustments (dividends minus deductions from subsidiaries)

(105)

-

Tax on foreign profits

64

-

Adjustments due to changes in tax rates

115

-

Tax expense (income)

(11,954)

1,521

The breakdown of income tax expense/ (income) is as follows:

Thousands of euros

2015

Income statement

Directly recognized in equity

Current income tax

9,961

-

9,961

-

Change in deferred tax assets and liabilities

Other temporary differences

17,460

-

Adjustments due to changes in tax rates

555

-

27,976

-

Thousands of euros

2014

Income statement

Directly recognized in equity

Current income tax

(41)

-

(41)

-

Change in deferred tax assets and liabilities

Other temporary differences

(12,028)

1,521

Adjustments due to changes in tax rates

115

-

(11,954)

1,521

Corporation tax Law 27/2014, of November 27, modified the general tax rate to 28% in 2015, and 25% for subsequent

years. As a result, the Company adjusted the deferred tax assets and liabilities from prior years based on the prevailing

rate at the estimated reversal date.