60

MEDIASET ESPAÑA COMUNICACIÓN, S.A.

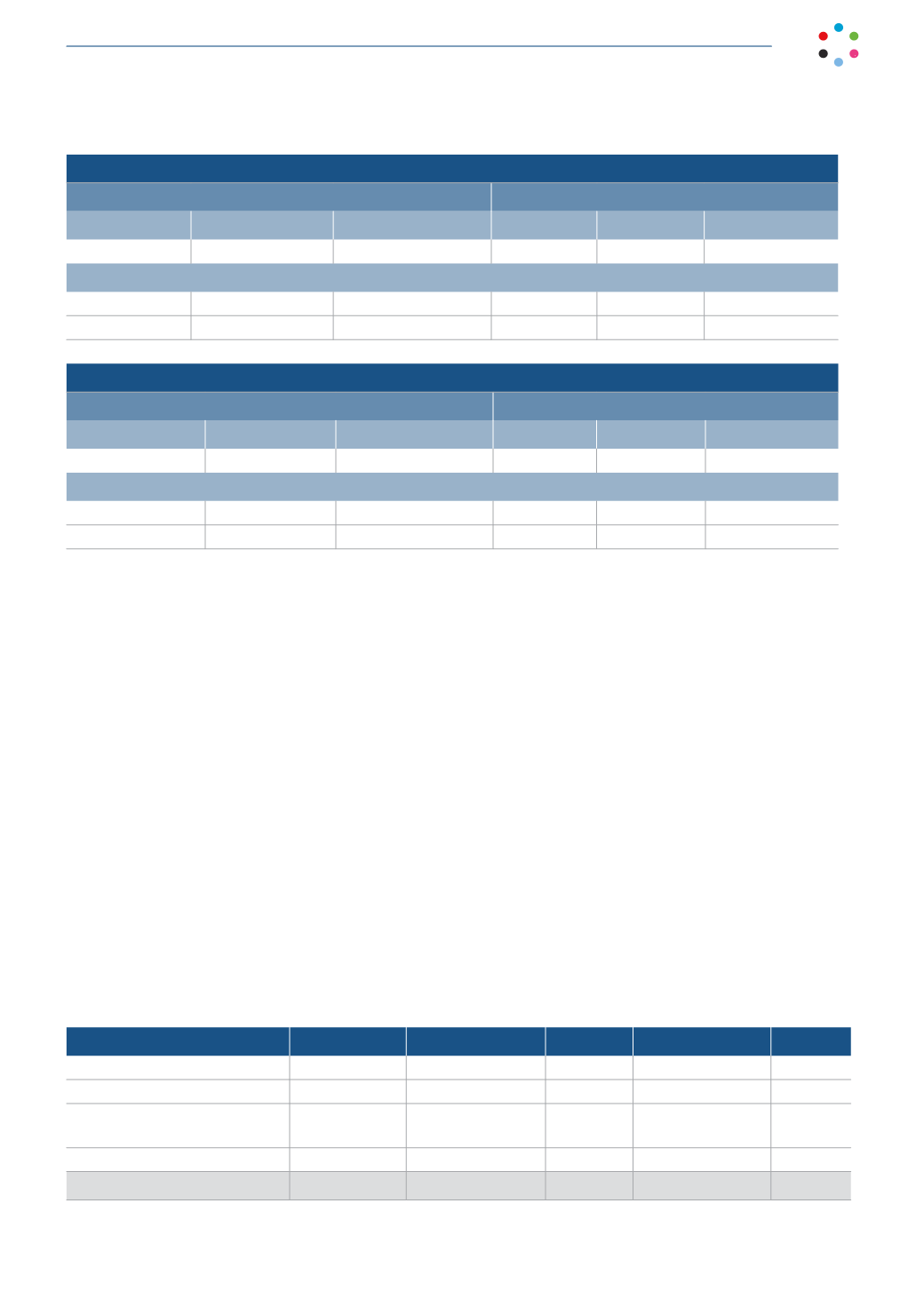

IMPORT EXCHANGE INSURANCE

12/31/2015

12/31/2015

USD

Exc. Rate

Differences

USD

Exc. Rate

Differences

22,082

1.0887

865

21,026

1.2141

1,193

Sensitivity Test

22,082

0.9791

3,117

21,026

1.1059

2,880

22,082

1.1983

(976)

21,026

1.3223

(219)

EXPORT EXCHANGE INSURANCE

12/31/2015

12/31/2014

USD

Exc. Rate

Differences

USD

Exc. Rate

Differences

83

1.0887

1

393

1.2141

(16)

Sensitivity Test

83

0.9791

(8)

393

1.1059

(48)

83

1.1983

8

393

1.3223

10

3. Liquidity risk

The Company’s financial structure is at a low liquidity risk, given the absence of financial leveraging and the recurrence

of operational cash flow generated every year.

Liquidity risk would result from the Company having insufficient funds or access to sufficient funds at an acceptable cost

to meet its payment obligations at all times.The Company’s objective is to maintain sufficient available funds.

The Company’s policies establish the minimum liquidity levels required at all times:

• Excess liquidity may only be invested in certain types of assets (see previous section on credit risk/investment

activities) the liquidity of which is guaranteed.

• The amount of the Company’s revolving credit lines ensures that the Company is able to meet its operating needs

as well as finance new short-term investment projects. At year-end 2015, the credit lines available totaled 280,000

thousand euros (entirely available). At year-end 2014, the credit lines available totaled 345,000 thousand euros (none

of which had been drawn down). Given the market situation, these credit lines have been contracted under very

competitive financial conditions, which strengthen the financial sector’s perception that the Company is creditworthy.

The undiscounted contractual maturity dates of financial liabilities at December 31, 2015 are as follows:

Thousands of euros

Up to 6 months 6 months - 1 year 1-5 years More than 5 years

Total

Non-current borrowings

-

-

7,554

-

7,554

Current borrowings

76,148

25

-

-

76,173

Current borrowings from

Group companies and associates

-

130,058

-

-

130,058

Trade and other payables

83,096

21,304

-

-

104,400

159,244

151,387

7,554

-

318,185