55

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

b) Available-for-sale financial assets

In 2014, this included unlisted minority financial investment which were sold to Advertisement 4 Adventure, S.L.U.

(Note 7.2.1.).

c) Derivatives

The Company uses derivatives to hedge its risks against foreign-currency fluctuations on the purchase of audiovisual

property rights made in the year. It also hedges against foreign currency risk on commercial transactions with customers,

and these transactions were recognized in the Company’s balance

sheet.Asrequired by the corresponding measurement

and recognition policy, these derivatives are classified as “held for trading.”

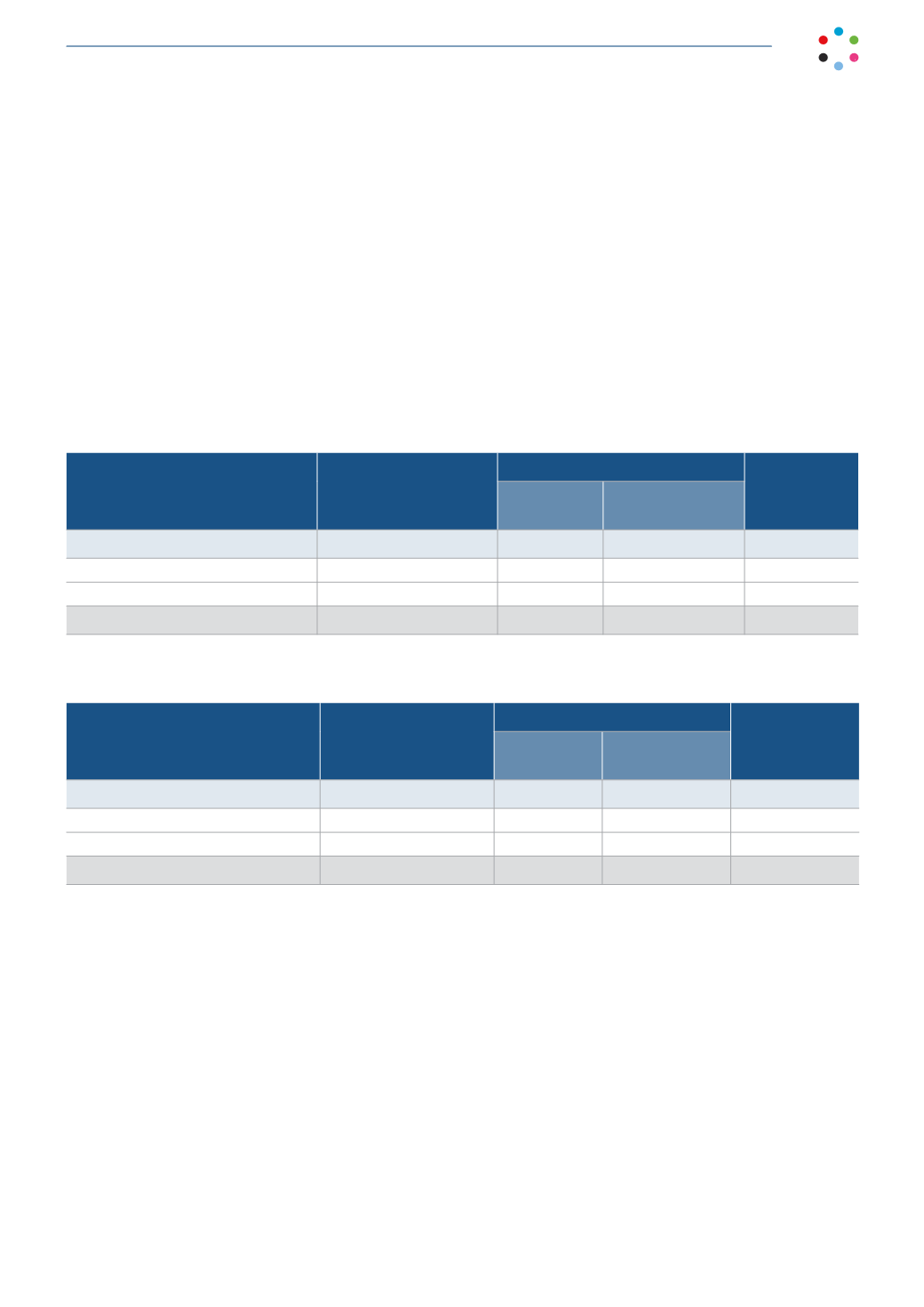

The breakdown of the notional amounts of derivatives outstanding at the Company at December 31, 2015 is as follows:

Assets

Notional amount/

Maturity up to one year

Amount in $

Fair value

Dollars

Year - end

(€/$) exc. rate)

Purchase of unmatured currency

Purchase of dollars in euros

19,413

22,165

1.0887

866

Sales of dollars in euros

-

-

-

-

Net

19,413

22,165

1.0887

866

The breakdown of the notional amounts of derivatives outstanding at the Company at December 31, 2014 is as follows:

Assets

Notional amount/

Maturity up to one year

Amount in $

Fair value

Dollars

Year - end

(€/$) exc. rate)

Purchase of unmatured currency

Purchase of dollars in euros

16,096

21,026

1.2141

1,193

Sales of dollars in euros

-

-

-

-

Net

16,096

21,026

1.2141

1,193

Foreign currency hedges on rights contracts are measured as the difference between the present value of the foreign

currency hedge at the forward rate for the contract and the value of the foreign exchange hedge at the year-end

exchange rate.

d) Non-current assets held for sale

This included a minority financial investment of 7,932 thousand euros corresponding to Grupo Yamm Comida a

Domicilio, S.L., which was planned for sale at year-end 2014, and was then sold on January 25, 2015, generating a 5,432

thousand euro gain, recognized under Gains (losses) on disposals and other gains (losses)”.