57

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

b) Derivatives and other financial liabilities

b.1) Non-current borrowings

“Non-current borrowings” mainly includes a loan granted by Catalunya Comunicacio, S.L.U. totaling 8,800 thousand

euros for the acquisition of the investment in Emissions Digitals de Catalunya, S.A.U., of which 1,061 were classified as

current in 2015. Said loan matures in 4 years and bears an interest rate of 2%. In 2015, a total of 359 thousand euros

had been repaid.

b.2) Borrowings from Group companies

The interest rate on these borrowings is EURIBOR plus a market spread. Loans to Group companies consist of swap

facilities. Also included under this heading are current payables for income tax payable with Group companies stemming

from the tax consolidation. Note 19 provides the breakdown of these balances.

b.3) Others

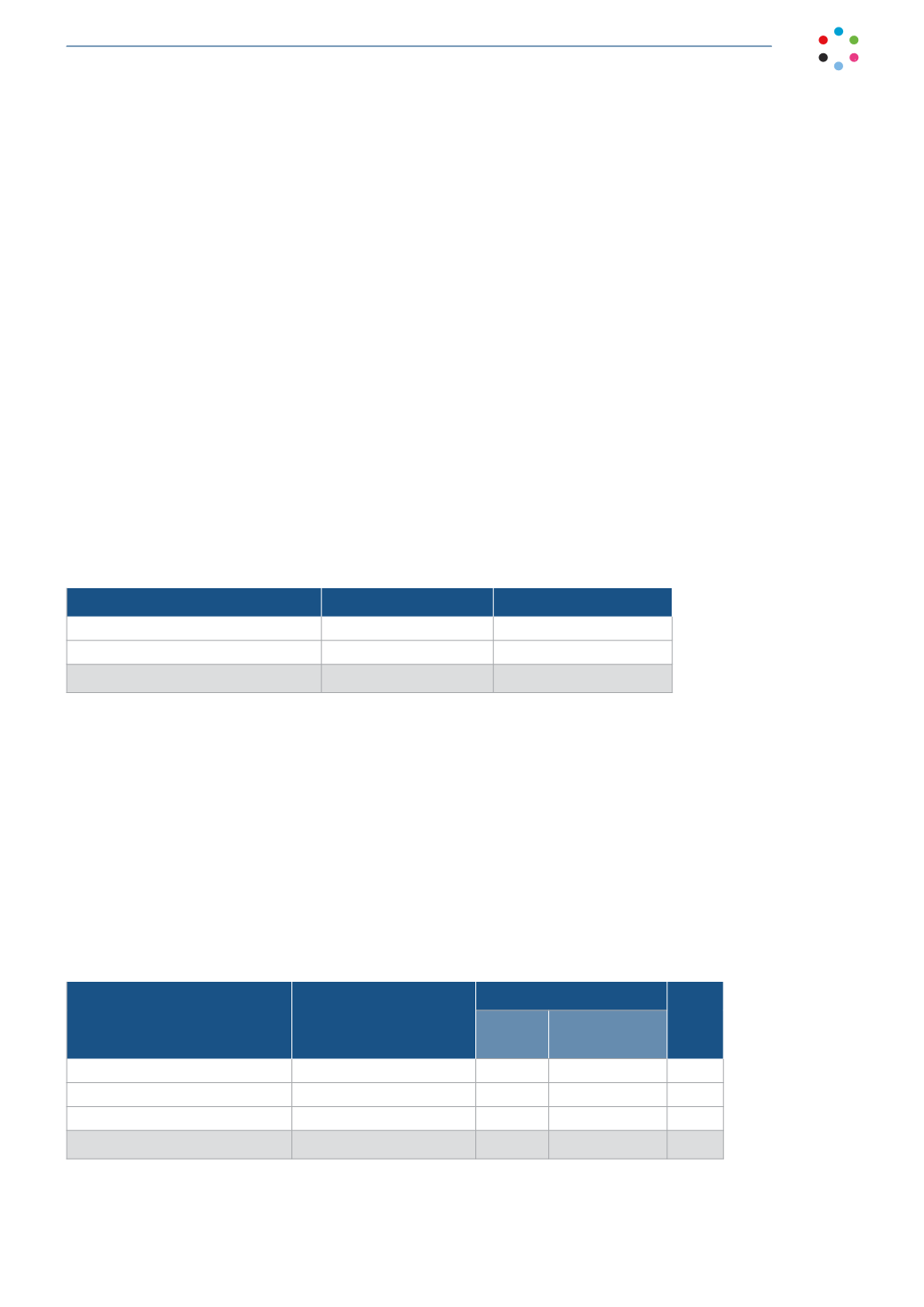

The breakdown at December 31, 2015 and 2014 is as follows:

Balance 12/31/15

Balance 12/31/14

Trade and other payables

104,400

94,879

Other financial liabilities

76,148

74,967

180,548

169,846

Other financial liabilities mainly consist of current borrowings from suppliers of audiovisual rights.

b.4) Derivatives

The Company carries out derivative transactions to hedge currency risk on the purchases of audiovisual property rights

in the year and when necessary to hedge currency risk on trade transactions in other currencies with customers, which

are recognized in the Company’s balance sheet. As required by the corresponding measurement and recognition policy,

these derivatives are classified as “held for trading.”

At year end 2015, derivative financial instruments were recognized under “Financial assets” (Note 8.1.c).

The breakdown of the notional amounts of Company’s derivatives at December 31, 2014 was as follows:

Liabilities

Notional amount/Maturity

up to one year

Amount in thousand $

Fair

value

$

(€/$)

exchange rate

Purchase of unmatured currency:

Purchase of dollars in euros

-

-

-

-

Sale of dollars in euros

307

393

1.2141

(16)

Net

307

393

1.2141

(16)

The foreign currency derivatives associated with the property rights are measured at the difference between the

present value of the quoted foreign currency hedge at the forward exchange rate in the contract and the value of the

quoted foreign currency hedge at year end.