65

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

13. CAPITAL AND RESERVES

a) Issued capital

On April 15, 2015, at the Annual General Meeting, the shareholders agreed to a share capital decrease amounting to

20,343 thousand euros through the redemption of 40,686,142 treasury shares, representative of 10% of share capital

when this decision was made, leaving share capital at 183,088 thousand euros.

At December 31, 2015 the share capital consisted of 366,175,284 shares with a value of 0.50 euros each, represented

by a book-entry system (406,861,426 shares with a value of 0.50 euros each at December 31, 2014). Share capital is

fully subscribed and paid-up and the breakdown of ownership is as follows:

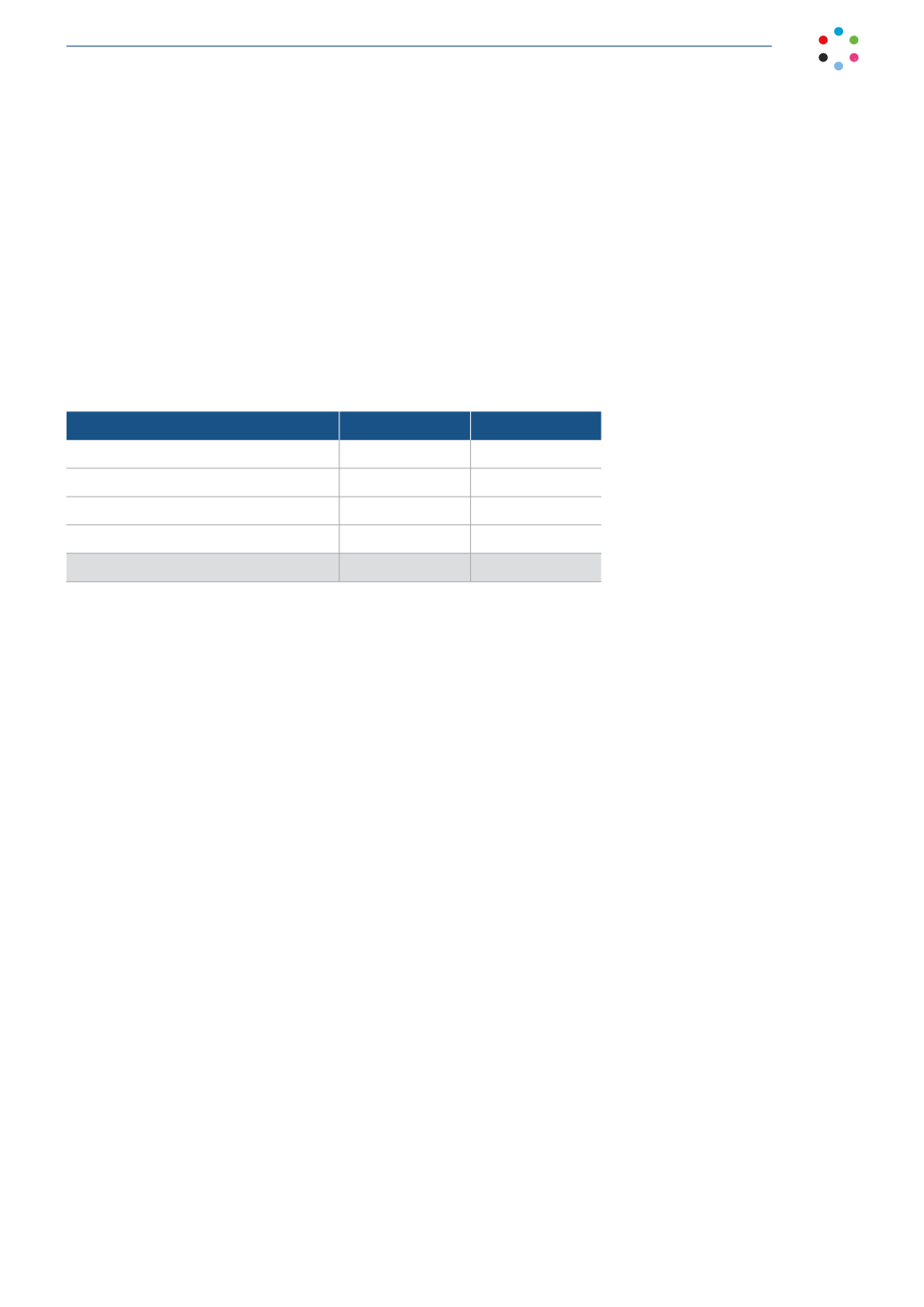

Shareholder

12.31.15

12.31.14

Mediaset S.P.A.

46.17

41.55

Free float

48.51

45.13

Treasury shares

5.32

9.66

Promotora de Informaciones, S.A.

-

3.66

Total

100

100

All the shares making up the company’s issued capital enjoy the same rights.

Share transfers are governed by the General Audiovisual Communication Law 7/2010, of March 31.

Listing on the Stock Exchange:

The Company was admitted for listing on the Stock Exchange on June 24, 2004. On January 3, 2005, its shares were

included on the IBEX 35. Its shares are traded on the Madrid, Barcelona, Bilbao, andValencia Stock Exchanges.

b) Share premium

The share premium can be freely distributed.

This decrease in 2015 was due to the capital decrease approved by the shareholders in general meeting on April 15,

2015.

c) Legal reserves

The companies are required to transfer 10% of each year’s profit to a legal reserve until this reserve reaches an amount

at least equal to 20% of share capital.This reserve cannot be distributed to shareholders, and may only be used to offset

losses if no other reserves are available.

d) Goodwill reserve

Effective January 1, 2016, this reserve will be reclassified to voluntary reserves, and will be available in the amount which

surpasses goodwill recorded on the assets side of the balance sheet.