41

FINANCIAL STATEMENTS AND MANAGEMENT REPORT 2015

Additions in 2015 and 2014 are due primarily to the acquisition of plant for the Company to continue its business.

Decreases in 2015 and 2014 relate primarily to idle and fully depreciated assets that the Company has eliminated from

its balance sheet.

Additions included under “Property, plant, and equipment under construction” during the year mainly included the

purchase of technical installations used to transform the studios, as well as high-definition mobile units.

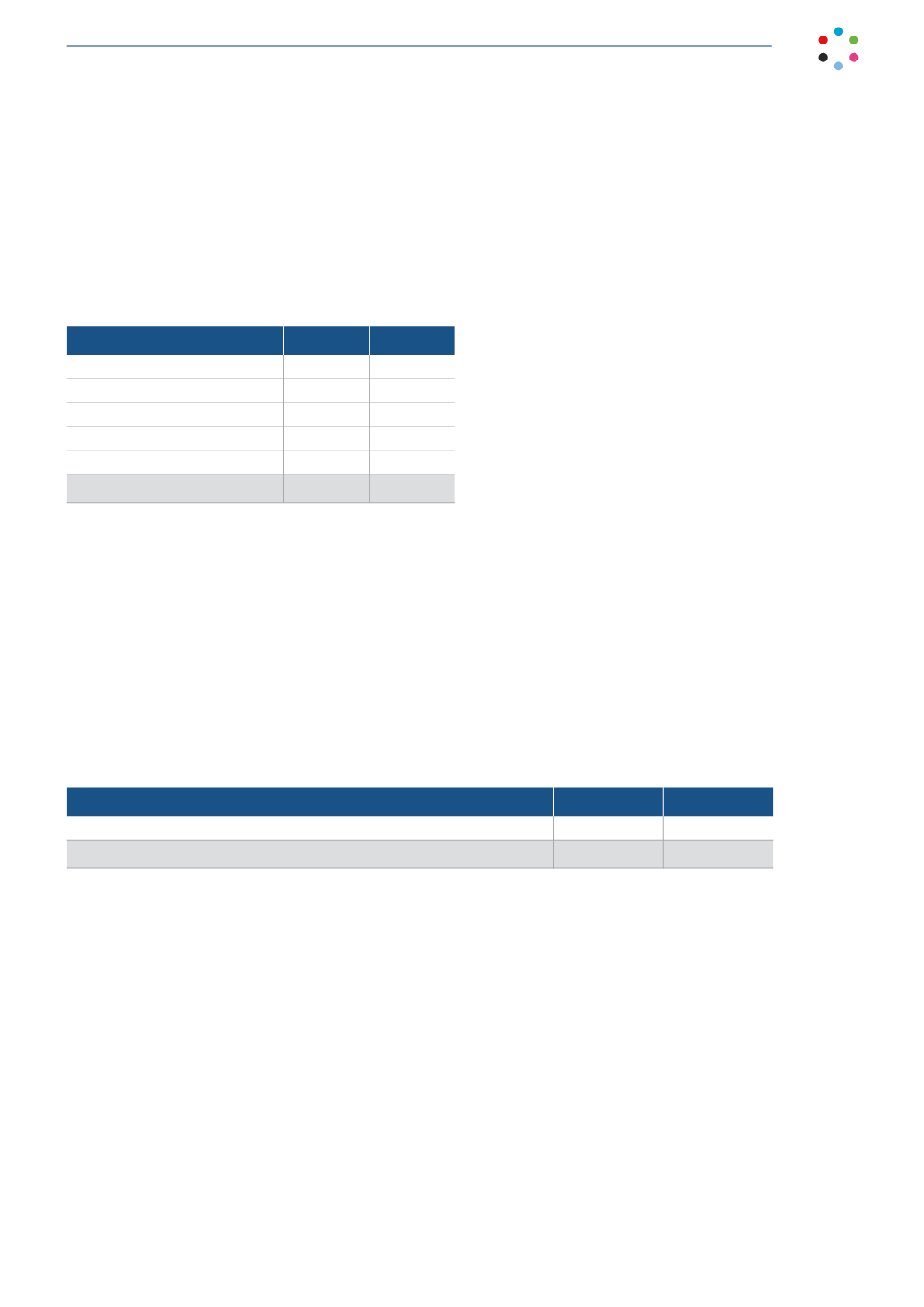

At December 31, 2015 and 2014, the amounts of fully depreciated assets still in use are as follows:

2015

2014

Data processing equipment

9,597

9,039

Buildings

850

-

TV equipment, plant, and tools

67,415

69,515

Other PP&E

425

425

Furniture and fixtures

2,083

1,772

80,370

80,751

In 2015 and 2014, the Company did not acquire of items of property, plant, and equipment from group companies.

The Company has taken out insurance policies to cover the possible risks to which its property, plant, and equipment

are subject and related claims which might be filed.These policies are considered to adequately cover the related risks.

Operating leases

Amounts recognized under “Operating leases” are as follows:

Thousand of euros

2015

2014

Operating lease payments recognized as loss/profit for the year (Note 18.d)

676

640

676

640

The Company’s future lease payments fall due within a year and are for similar amounts to those assumed during the

year.