163

CONSOLIDATED FINANCIAL STATEMENTS AND CONSOLIDATED MANAGEMENT REPORT 2015

13. NON-CURRENT ASSETS HELD FOR SALE

In 2014, the Group’s stake in Grupo Yamm Comida a Domicilio, S.L. was transferred to “Non-current assets held

for sale,” which was then sold on January 26, 2015. This divestiture resulted in a 5,438 thousand euro profit which is

recognized under “Gains (losses) on disposals of non-current assets available for sale”.

On June 30, 2014, the 22% investment in DTS, Distribuidora deTelevisión Digital, S.A. (hereinafter, DTS), was transferred

to “Non-current assets held for sale”, adjusting its value to Telefónica de Contenidos S.A.U.’s purchase offer; the latter

is also a shareholder of the Company, and the offer was accepted by the Group.The purchase-sale agreement for the

above investment was signed by both parties on July 4, 2014.

In 2015, 10,000 thousand euros in additional compensation were received whenTelefónica acquired the Prisa package of

shares in DTS, which were recognized during the year under “Gains (losses) on disposals of non-current assets available

for sale “. In 2015, the additional complementary amount of up to 30,000 thousand euros was open, arising from the

potential increase in the number of platform subscribers from the time control passed to Telefónica, with an effective

four-year period from that moment onward.

14. CASH AND CASH EQUIVALENTS

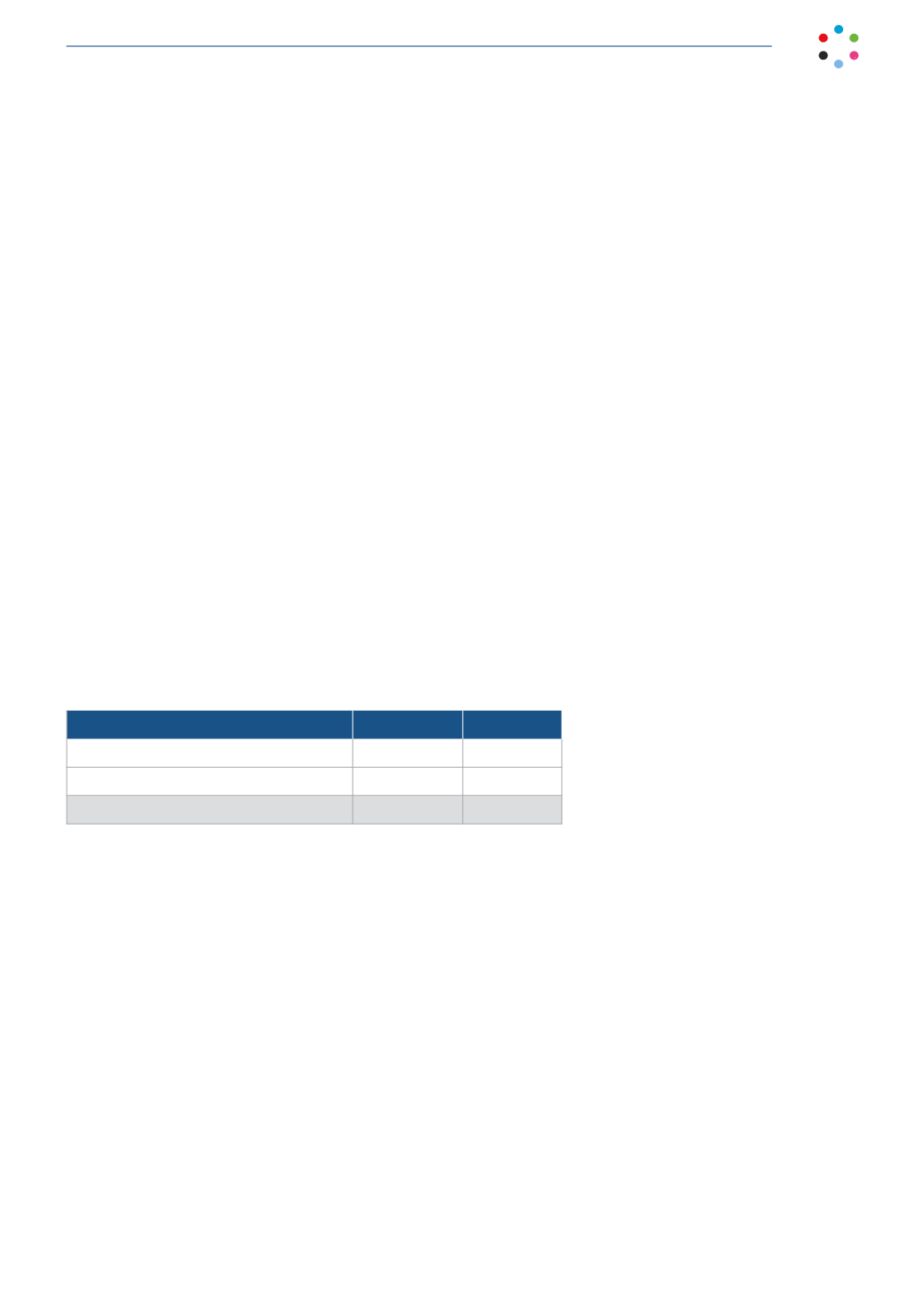

The breakdown of “Cash and cash equivalents” is as follows:

12/31/2015 12/31/2014

Cash

211,397

145,779

Short-term deposits

-

130,003

Total

211,397

275,782

”Short-term deposits” included a simple repo transaction (Treasury bills) totaling 130,000 thousand euros.

No restrictions to the availability of balances exist.