142

MEDIASET ESPAÑA COMUNICACIÓN, S.A. AND SUBSIDIARIES

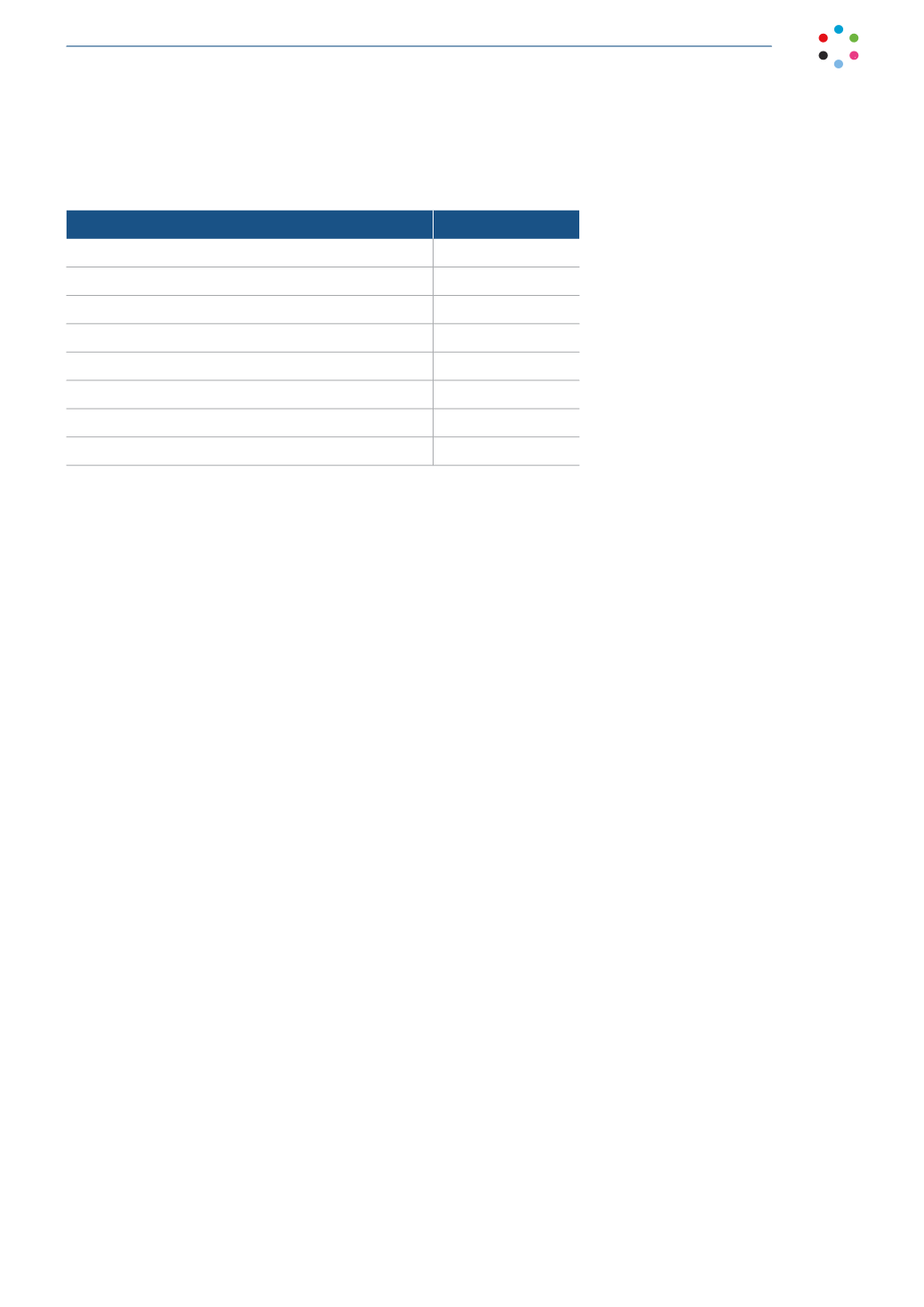

The depreciation rates used to calculate the decline in value of the various items of property, plant, and equipment are

as follows:

Rate

Buildings

3 %

TV equipment

20 %

Fixtures

10 %

Tools

20 %

Furniture

10 %

Computer hardware

25 %

Transportation equipment

14-15 %

Other items of property, plant, and equipment

20 %

4.6. Intangible assets

Intangible assets acquired separately are measured on initial recognition at cost.The cost of intangible assets in a business

combination is fair value at the date of the acquisition. Following initial recognition, intangible assets are carried at cost

less any accumulated amortization and any accumulated impairment losses. Intangible assets are recognized as such only

when the Group can demonstrate how the asset will generate future economic benefits and the ability to measure

reliably the expenditure during development.

•

Development expenditure

Expenditure on development activities is recognized as an expense as incurred, except in the case of computer software

projects that have reached the development stage.These expenses are measured at cost and are allocated to specific

projects until the projects have been completed, provided there is a reasonable assurance that they can be financed

through completion and there are sound reasons to foresee their technical success.

•

Concessions, trademarks and trade names

These relate mainly to licenses to use industrial property rights and television channel concessions.

The“Cuatro” trademark and the“Cuatro”multiplex operators’ license were identified in the Sogecuatro Group purchase

price allocation.The “Cuatro” trademark has an estimated useful life of 20 years.

The license is considered to be an intangible asset with an indefinite useful life. Intangible assets with indefinite useful

lives are not amortized, but are assessed for impairment at least annually or when there are indications of impairment.

•

Computer software

This includes the amounts paid for title to or the right to use computer programs. Computer software maintenance

costs are recognized with a charge to the income statement for the year in which they are incurred.

Computer software is amortized over three years from the date on which it starts to be used.